With Ethereum still down more than 60% from its all-time high, traders are asking the question:

“Is it too late to buy ETH — or is this the perfect entry?”

While short-term sentiment remains mixed, the macro landscape is quietly setting the stage for Ethereum’s next leg up. Between the looming approval of staking-enabled ETFs, upcoming protocol upgrades, and Ethereum’s dominance in real-world asset tokenization, it’s becoming harder to ignore one of the most fundamentally sound assets in crypto.

Let’s break down why now — not later — might be the window long-term investors will wish they capitalized on.

💡 Ethereum’s Current Price Action: Opportunity or Trap?

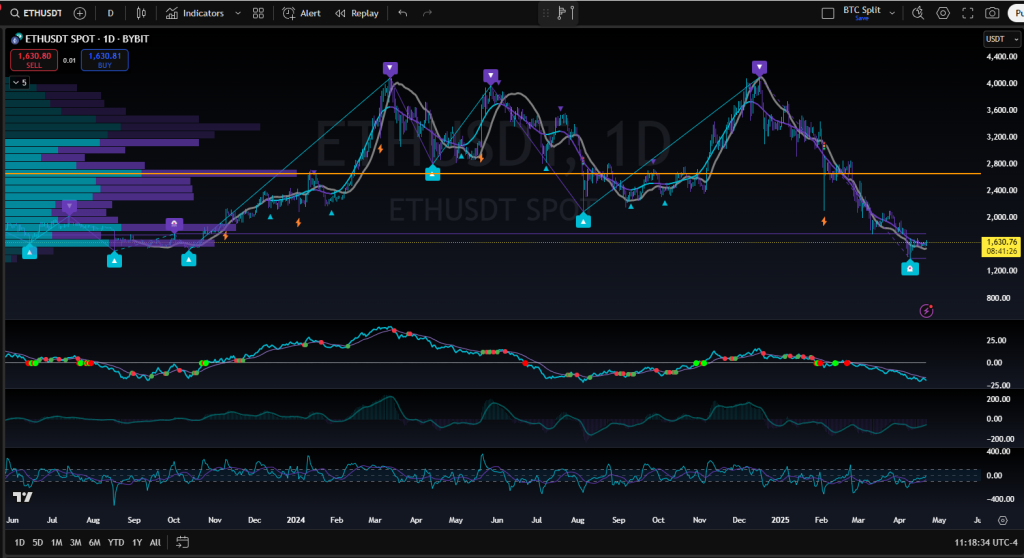

As of April 21, 2025, Ethereum is trading at approximately $1,643.48, a modest 3.26% increase over the past 24 hours. On the surface, it might seem stagnant — especially compared to some of the smaller altcoin moonshots. But zoom out, and the chart tells a different story:

- ETH is still hovering around its 2022–2023 bear market levels

- Price has respected a long-term support zone near $1,600 for months

- Volume is increasing during accumulation zones, not sell-offs

This is exactly where smart money enters. Historically, bear market accumulation zones have produced the most explosive returns once macro conditions shift.

🏛️ Institutional Money Is Eyeing ETH — Big Time

The biggest development in 2025 isn’t on the charts — it’s behind the scenes:

- BlackRock, Fidelity, and other giants have already filed and launched Ethereum Spot ETFs

- These ETFs, once approved for staking, will give institutions yield on ETH — a massive incentive

- The SEC is expected to rule on staking features by June 1, 2025

Why does this matter?

Because institutional capital makes up the majority of global trading volume — and these investors don’t chase tops. They buy scalable infrastructure with long-term upside.

If staking gets approved within ETF structures, Ethereum becomes the first digital asset to offer programmable yield through traditional finance — a game-changer.

🧠 Ethereum Is Dominating Real-World Asset Tokenization

Here’s the kicker: while most people are watching price, Ethereum is quietly dominating real-world asset adoption.

- As of April 2025, Ethereum holds over 50% of the entire RWA market share, with $5B in tokenized real estate, treasuries, and commodities

- Projects like Franklin Templeton, BlackRock, and Citi are using Ethereum infrastructure for these offerings

This isn’t theory — it’s happening now. Ethereum is bridging TradFi and DeFi, and it’s happening on-chain, not just in the headlines.

🔧 Upcoming Protocol Upgrade: Pectra

Another reason ETH remains a top-tier long-term investment?

The next scheduled upgrade — Pectra, set to go live in May 2025 — will improve:

- Validator performance

- Staking efficiency

- Data throughput and scalability

This directly boosts Ethereum’s ability to support massive user bases and real-world adoption without sacrificing decentralization.

Upgrades like this aren’t just hype — they solve real bottlenecks and further cement Ethereum as the infrastructure layer of Web3.

📊 ETH Price Forecast: What’s Next?

While no prediction is guaranteed, here’s what we’re watching:

- Support: $1,540–$1,600

- Resistance: $1,750–$1,830

- Upside Target by Q3 2025: $2,400+

Analysts are already projecting Ethereum to reach $3,000–$4,000 by 2026 if ETF staking unlocks. That’s nearly a 2x–3x from current levels — on a blue-chip, yield-bearing, real-world-integrated asset.

That’s not just investment — that’s positioning for the next cycle.

🚀 Want to Learn How to Catch Moves Like This?

The EPIQ Trading Floor is where everyday traders become top 5% thinkers. We break down moves like this in real time — and teach you how to:

✅ Identify high-conviction entries using real data

✅ Use volume, macro context, and structure to anticipate breakouts

✅ Build a repeatable trading system that works in bull or bear markets

✅ Gain confidence in long-term investments like ETH while actively trading short-term setups

🎓 3-day free trial. Active mentorship + private community.

👉 Join the EPIQ Trading Floor Today and start trading like the smartest in the room.

⚠️ Disclaimer: This content is for educational purposes only and does not constitute financial advice. Cryptocurrency investments involve risk. Always do your own research and consult a licensed advisor before investing.

Responses