Filecoin ($FIL), the decentralized data storage giant, continues to navigate a choppy range as traders await confirmation of its next macro move. As of April 2, 2025, FIL is trading at approximately $6.11, holdiFilecoin ($FIL), one of the leading decentralized storage networks in Web3, continues to trade near multi-month lows — with today’s price action hovering around $2.83, reflecting a narrow -0.15% move over the last 24 hours. The token remains under pressure after a month of declining volume and a failure to reclaim major moving averages.

But with key support zones holding and volatility compressing, the charts are flashing early signs that a larger move could be coming — the question is: up or down?

🔍 Current Price Overview

- Price: $2.83

- 24H Range: $2.79 – $2.87

- Market Cap Rank: #38

- Volume: Significantly below 30-day average, signaling indecision or consolidation

- Trend Bias: Bearish on macro, neutral-to-accumulative on micro

📊 Technical Analysis Breakdown

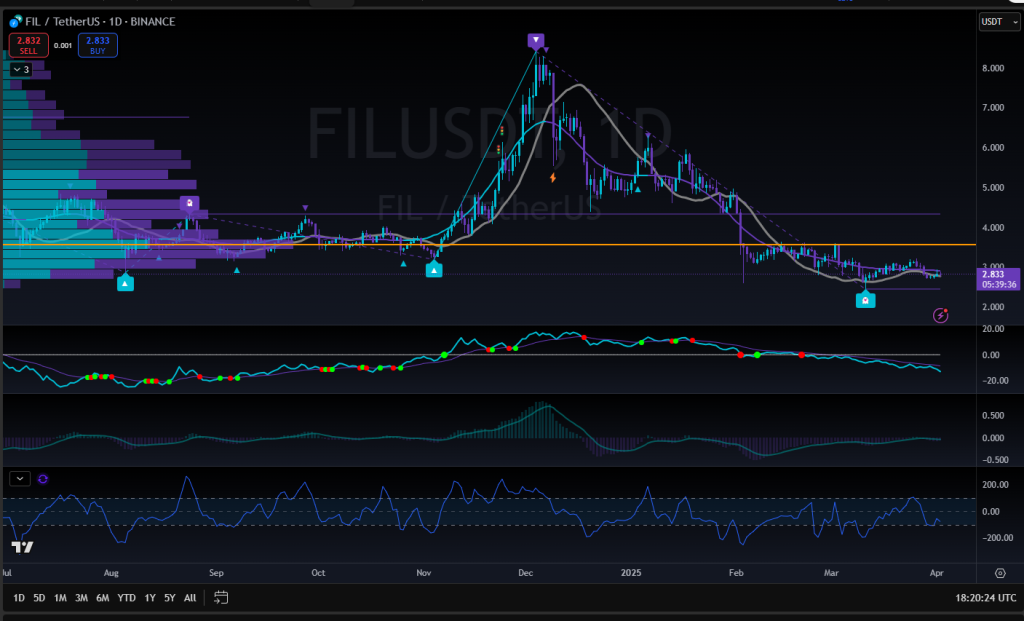

Trend Structure (Daily Chart)

FIL has been stuck in a downward-sloping channel since early March, with lower highs forming consistently around the $3.10–$3.20 zone. However, the last few daily candles show smaller real bodies and long wicks, indicating seller exhaustion near the $2.75–$2.80 support level.

Price remains compressed between two key zones:

- Resistance: $3.00 (psychological + 21-day EMA)

- Support: $2.75 (bottom of the current range and prior demand zone from Q4 2023)

A break above $3.00 on volume could flip the short-term structure bullish, while a loss of $2.75 may open the door to new yearly lows near $2.40.

Volume & Volatility

Volume has continued to decline week over week, indicating a potential volatility squeeze. When paired with Bollinger Band tightening, this suggests a larger move is on the horizon. Smart traders will be watching for expansion and confirmation before jumping in.

Momentum Indicators

- RSI (14D): 41

RSI is weak but diverging positively from price. Price made a new low while RSI did not — a classic early signal for a potential reversal. - MACD: Bearish, but beginning to flatten

If a bullish crossover forms later this week, it could be the early momentum trigger for a short-term relief rally. - 200D EMA: Far above at ~$4.10, and not currently in play.

Recovery of the 21D EMA near $3.00 would be the first technical victory for bulls.

🧠 Narrative Watch: Could Storage Coins Come Back in Focus?

While AI and meme coins dominate headlines, decentralized infrastructure plays like Filecoin, Arweave, and Bittorrent have lagged. That could change quickly.

AI models require massive data storage, and as more models shift to on-chain inference, decentralized data protocols could reenter the narrative rotation. This puts projects like FIL in a “narrative sleeper zone” — out of favor now, but ready to pop when attention returns.

✅ Strategic Takeaways for Traders

- Bullish Scenario: Break above $3.00 with volume → test of $3.30–$3.50 range.

- Bearish Scenario: Breakdown below $2.75 → likely test of $2.40–$2.20 support.

- Neutral Strategy: Monitor for volatility expansion and use RSI/momentum divergence as early signals.

Range-bound accumulation plays like this offer strong risk/reward trades if you’re patient and selective.

🚀 Ready to Trade Like a Pro? Join the EPIQ Trading Academy Today

If you’re tired of guessing and want real structure to your trading…

The EPIQ Trading Academy gives you access to everything you need to go from beginner ➝ consistent ➝ strategic trader:

🎓 18+ hours of premium educational content

📈 Proven strategies for crypto, forex, and leverage trading

🔒 One-time payment, lifetime access

✅ Get certified upon completion

💬 Bonus: Access to our mentorship Discord community

👉 Join the Academy now and get access instantly — no subscriptions, no fluff.

⚠️ Disclaimer: This content is for informational and educational purposes only. It is not financial or investment advice. Cryptocurrency trading involves risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial advisor before making investment decisions.

Responses