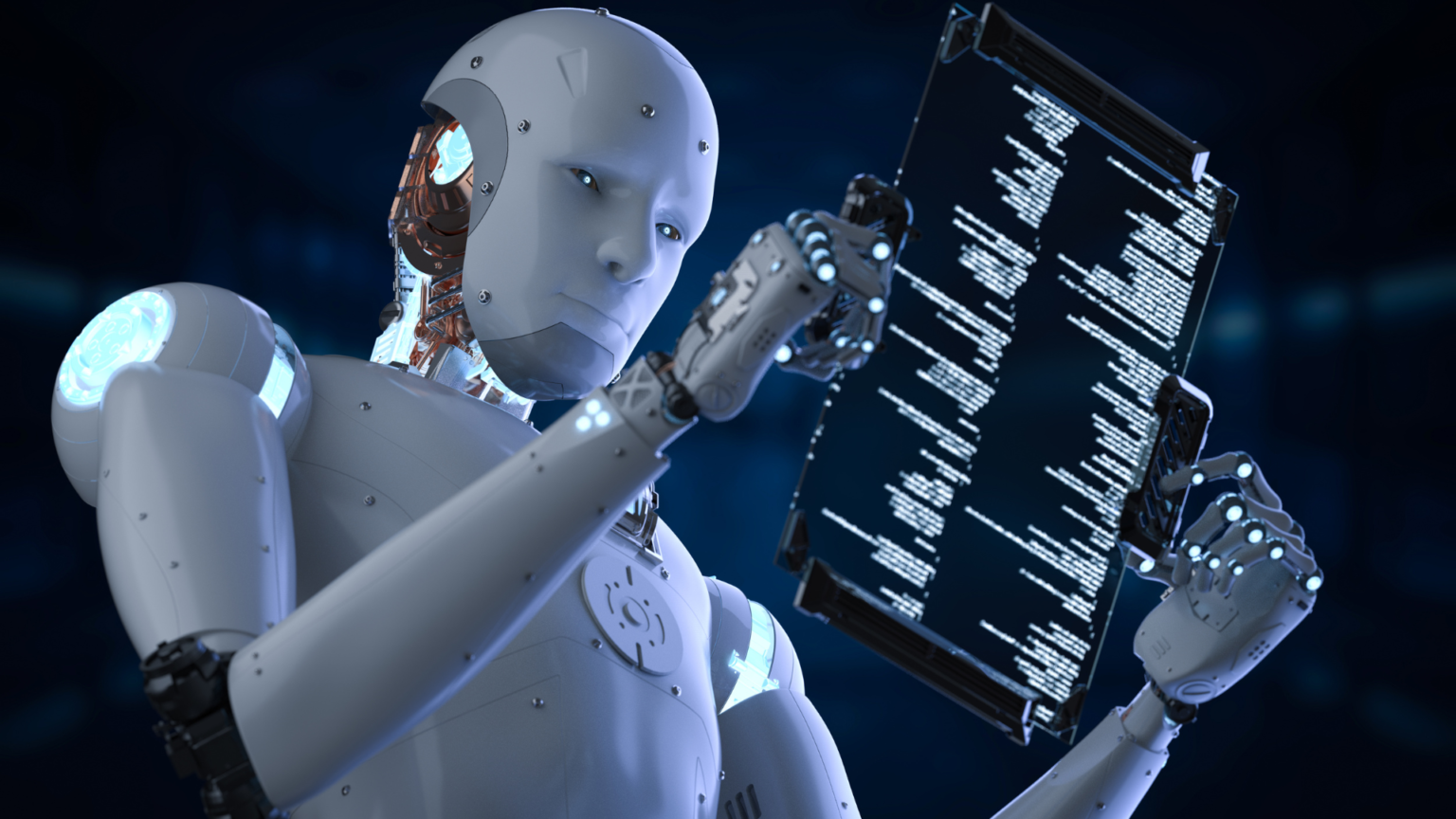

Super Micro Computer (SMCI), a leading provider of high-performance computing and storage solutions, saw its stock soar by 16% following an announcement that it posted solid shipping numbers in the AI server market. The company, which had faced pressure due to broader concerns in the tech sector, is now experiencing a strong rebound, largely fueled by the growing demand for AI servers. This recent surge highlights the importance of AI-driven technologies and the increasing role of high-performance servers in the expanding artificial intelligence (AI) space.

In this blog, we’ll dive into the reasons behind Super Micro’s (SMCI) stock jump, the outlook for AI server makers, and strategies for trading SMCI stock. We’ll also explore how EPIQ Trading Floor can help traders stay informed and take advantage of real-time market movements with expert insights and signals.

1. What’s Driving Super Micro’s Stock Rally?

Super Micro has been at the forefront of the AI revolution, providing cutting-edge server technology that powers many of the applications and infrastructures used in AI and machine learning today. Despite some market challenges, the company has shown resilience, posting solid shipping numbers that have reassured investors about its growth prospects.

A. Growth in AI Server Demand

The surge in demand for AI servers has been one of the key factors driving Super Micro’s recent performance. With AI applications requiring significant processing power and data storage capabilities, companies across industries are increasingly investing in high-performance servers to support these workloads. Super Micro’s ability to deliver these solutions at scale has positioned it well to capitalize on this trend, resulting in a boost to its stock price.

As more companies adopt AI technologies, the demand for powerful servers is expected to grow. According to a recent market analysis, the global AI server market is projected to continue its expansion, creating significant opportunities for companies like Super Micro. Learn more about the AI server market and its growth potential.

B. Recovery in Tech Stocks

In addition to the specific demand for AI servers, the broader recovery in tech stocks has contributed to Super Micro’s stock rally. The tech sector has faced volatility in recent months due to rising interest rates, inflation, and geopolitical tensions. However, with market conditions stabilizing, tech stocks, including Super Micro, are experiencing a recovery, supported by improving investor sentiment.

The solid shipping numbers reported by Super Micro have given investors confidence that the company is well-positioned to benefit from the AI-driven growth in the tech space, which further fueled the 16% stock surge.

Key Takeaway: Super Micro’s stock rally is driven by strong demand for AI servers and the broader recovery in tech stocks. As AI adoption continues to grow, companies providing the underlying infrastructure, like Super Micro, are well-positioned for continued success.

2. Key Technical Levels for Super Micro (SMCI)

For traders interested in taking advantage of the momentum in Super Micro stock, it’s crucial to understand the key technical levels and chart patterns that could signal future price movements.

A. Support and Resistance Levels

After the recent surge, traders should look for key resistance levels where the stock might face selling pressure. As of now, $320 is a critical resistance level. If Super Micro breaks through this resistance, it could signal further upside potential. On the downside, $270 serves as a strong support level, and a break below this could indicate a reversal in the stock’s bullish momentum.

B. Moving Averages

The stock’s performance relative to its 50-day and 200-day moving averages can provide valuable insights into the overall trend. With Super Micro currently trading above both moving averages, the stock remains in a bullish phase. However, traders should monitor these levels to assess whether the stock continues its upward momentum or faces a potential pullback.

Key Takeaway: Traders should watch for resistance at $320 and support at $270 while keeping an eye on key moving averages to identify potential trend changes.

3. What’s Next for Super Micro and the AI Server Market?

As AI technology continues to evolve, the demand for servers capable of handling complex AI workloads will remain strong. Here are some key trends to watch for the AI server market and Super Micro in particular:

A. Expansion of AI and Cloud Computing

The rapid expansion of AI and cloud computing is expected to drive long-term growth for AI server providers. As companies increasingly rely on cloud-based AI solutions, the demand for high-performance servers will rise, benefiting companies like Super Micro.

Additionally, data centers are becoming more sophisticated, requiring advanced hardware to support AI applications. This creates a significant growth opportunity for Super Micro as it continues to innovate and meet the demands of this fast-growing market. Read more about the impact of AI on cloud computing.

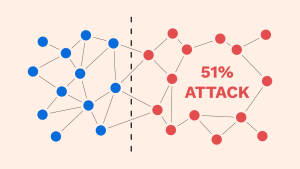

B. Competition in the AI Server Space

While Super Micro is currently experiencing strong demand for its AI servers, it faces competition from other major players in the space, such as NVIDIA and Dell Technologies. These companies are also expanding their AI server offerings, and Super Micro will need to continue innovating to stay ahead of the competition.

Key Takeaway: The expansion of AI and cloud computing will drive long-term growth for the AI server market, but Super Micro must continue innovating to stay competitive.

4. Trading Strategies for SMCI Stock

For traders looking to capitalize on the momentum in Super Micro stock (SMCI), it’s important to adopt the right trading strategies to manage risk and maximize potential returns.

A. Trend Following

Given the strong bullish trend in Super Micro stock, a trend-following strategy could be effective. Traders can use technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to confirm the strength of the trend and identify potential entry points.

B. Hedging with Options

For traders looking to hedge against potential downside risks, options strategies can provide protection. For example, purchasing put options on Super Micro can limit potential losses if the stock experiences a sudden reversal.

C. Diversify Your Portfolio

With the stock market experiencing volatility, it’s important to maintain a diversified portfolio. While Super Micro presents an exciting opportunity, traders should ensure that their portfolios include a mix of asset classes and sectors to reduce overall risk.

Key Takeaway: Trend-following strategies, hedging with options, and maintaining portfolio diversification can help traders navigate the current market conditions in Super Micro stock.

Stay Ahead of the Market with EPIQ Trading Floor

Navigating the fast-moving tech sector and AI server market requires access to real-time data, expert analysis, and proven trading strategies. That’s where EPIQ Trading Floor comes in. Whether you’re trading Super Micro stock or looking for opportunities in the broader market, EPIQ Trading Floor provides you with the tools you need to succeed.

EPIQ Trading Floor offers:

- Real-time trading signals to help you stay ahead of market movements.

- Expert analysis on trends, patterns, and technical levels.

- A community of traders who share insights and strategies to help you grow your portfolio.

Start your 3-day free trial today! Join EPIQ Trading Floor to access exclusive market insights, trading tools, and expert analysis that will elevate your trading game.

Disclaimer

The information provided in this blog is for educational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

Responses