The Rise of Tokenized Real-World Assets

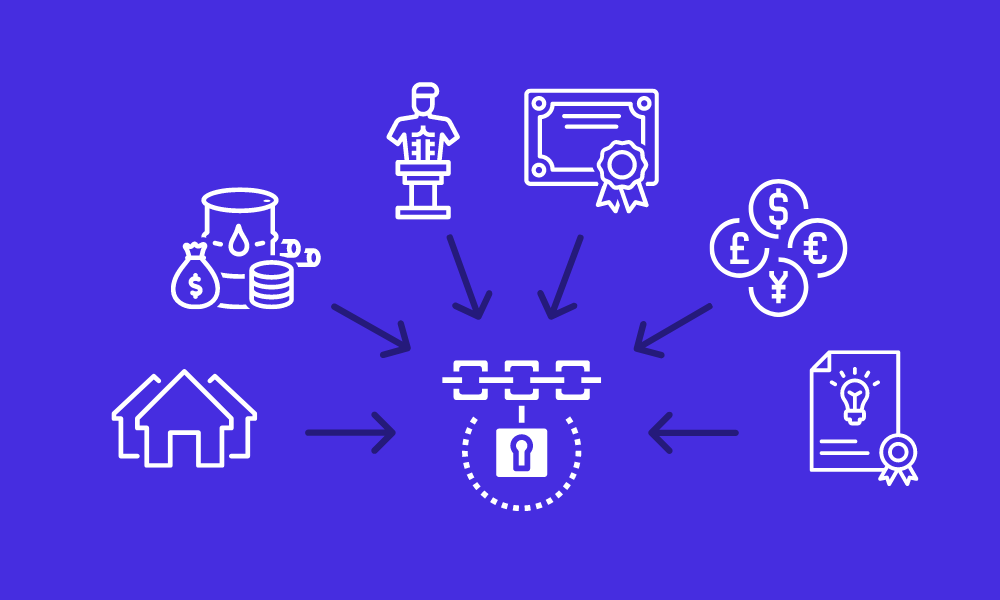

Decentralized Finance (DeFi) has already revolutionized financial services, but one of the most exciting emerging trends is Real-World Asset (RWA) tokenization. This concept involves converting physical assets—such as real estate, commodities, stocks, bonds, and even art—into digital tokens on the blockchain. By doing so, tokenization allows for fractional ownership, increased liquidity, and broader accessibility to investment opportunities that were previously out of reach for many investors.

For traders and investors looking to stay ahead of the curve, understanding RWA tokenization is crucial. This technology has the potential to drive the next phase of DeFi growth by bringing real-world economic value onto the blockchain. Whether it’s tokenized real estate allowing investors across the globe to own a share of a property or tokenized commodities providing exposure to precious metals, this trend is set to reshape financial markets.

At EPIQ Trading Floor, we provide cutting-edge insights into crypto and DeFi trends like RWA tokenization to help traders and investors stay informed. Use code “BLOG” at checkout for 10% off and enjoy a risk-free 3-day trial, giving you access to trade signals, exclusive market insights, and one-on-one coaching. Cancel anytime within 72 hours without being charged. Join now.

What is Real-World Asset Tokenization?

RWA tokenization refers to the process of representing ownership or rights to physical assets as blockchain-based digital tokens. These tokens can be bought, sold, traded, or used as collateral within DeFi protocols, bringing traditional assets into the crypto ecosystem. The benefits of tokenizing real-world assets are significant.

One major advantage is increased liquidity, as traditionally illiquid assets like real estate and fine art can become more accessible through fractional ownership. Tokenization also enables global accessibility, allowing investors worldwide to hold a stake in high-value assets without needing large amounts of capital. Additionally, transparency and security are significantly enhanced since blockchain technology ensures tamper-proof, verifiable ownership records. Lastly, lower costs and improved efficiency make tokenized assets a compelling alternative to traditional investment models by eliminating many intermediaries and streamlining transactions.

How RWA Tokenization Works

The tokenization process follows a structured framework involving asset selection, legal compliance, smart contract creation, and distribution. First, a physical asset is selected and valued, with its details recorded on the blockchain to create a digital representation. Compliance with regulatory frameworks is then addressed, as tokenized assets must adhere to local laws regarding ownership rights, securities, and property laws.

Once legally structured, the asset is tokenized through smart contracts, with each token representing a fraction of ownership or a claim on the asset’s revenue (such as rental income in real estate tokenization). These tokens can then be traded on DeFi marketplaces, used as collateral for loans, or staked to earn passive income. Investors can enter and exit positions easily, unlike the traditional ownership models that involve lengthy and expensive processes.

Examples of Real-World Asset Tokenization

Several pioneering projects have already made strides in the RWA tokenization space. Real estate tokenization is gaining traction, with platforms like RealT allowing investors to own tokenized shares of rental properties and receive passive income from tenants. In the commodities sector, projects such as Paxos Gold (PAXG) and Tether Gold (XAUT) issue gold-backed tokens, enabling crypto users to gain exposure to precious metals without physical storage.

The financial sector is also embracing tokenization, with governments and corporations exploring blockchain-based bonds and securities. Switzerland’s SIX Digital Exchange (SDX) has begun offering tokenized financial instruments. Meanwhile, the tokenization of fine art and collectibles allows investors to own shares of masterpieces through blockchain projects like Masterworks. These use cases highlight how RWA tokenization is bridging the gap between traditional and decentralized finance.

Challenges and Risks of RWA Tokenization

Despite its potential, real-world asset tokenization faces significant challenges that must be addressed before widespread adoption. One of the main concerns is regulatory uncertainty, as different jurisdictions have varying laws regarding asset-backed tokens, creating legal barriers for cross-border transactions. Governments are still working to create appropriate regulatory frameworks for blockchain-based securities.

Another issue is trust and legal enforceability. Since tokenized assets represent real-world ownership, mechanisms for legal enforcement, dispute resolution, and asset recovery must be properly established. Liquidity concerns also remain, as secondary markets for RWA tokens are still developing. Unlike crypto-native assets, real-world tokenized assets may take time to achieve sufficient trading volume.

Security is another important consideration. Like all DeFi applications, tokenized assets rely on smart contracts, which, if poorly coded, could be vulnerable to hacks, exploits, or system failures. Ensuring the integrity of smart contracts through rigorous audits and decentralized governance models is essential for building trust in the RWA ecosystem.

Final Thoughts: Is RWA Tokenization the Future of DeFi?

Real-world asset tokenization has the potential to bridge the gap between traditional finance and blockchain technology, unlocking trillions of dollars in illiquid assets. By enabling fractional ownership, reducing costs, and enhancing transparency, RWA tokenization could reshape investment markets, making them accessible to a global audience.

However, its success depends on regulatory clarity, legal infrastructure, and robust smart contract security. As the DeFi ecosystem matures, we can expect more institutions, corporations, and retail investors to embrace tokenized real-world assets as a new standard for financial markets. This shift could position blockchain technology as a critical component of global financial systems, driving innovation and efficiency in asset management.

At EPIQ Trading Floor, we provide expert guidance on emerging crypto and DeFi trends to keep traders and investors ahead of the curve. Our members-only app offers trade signals, private coaching, and live market analysis, ensuring you have access to the best tools for navigating the digital asset economy.

✅ Live trade signals

✅ Members-only livestreams

✅ One-on-one coaching

✅ Advanced trade setups and strategies

Use code “BLOG” at checkout for 10% off and start your risk-free 3-day trial today. Cancel anytime within 72 hours without being charged.

Disclaimer

This content is for educational purposes only and should not be considered financial advice. Cryptocurrency investments involve risk, and past performance does not guarantee future results. Always conduct your own research before making investment decisions.

Responses