Nvidia, a tech giant known for its leadership in graphics processing units (GPUs) and artificial intelligence (AI), has recently found itself under intense scrutiny. On September 3, 2024, Forbes reported that Nvidia was subpoenaed by the U.S. Department of Justice (DOJ) as part of a growing antitrust investigation. This development has sparked widespread concern across the tech and investment communities, as regulators are increasing their focus on big tech companies to prevent monopolistic practices.

In this blog post, we’ll break down what this antitrust probe means for Nvidia, the potential market impact, and what traders and investors should keep in mind as this situation develops.

Nvidia’s Antitrust Battle: What’s Going On?

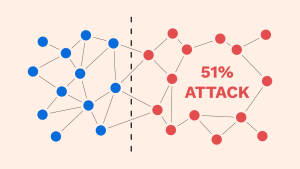

The DOJ’s antitrust investigation into Nvidia is reportedly centered around concerns that the company’s dominant position in the GPU and AI hardware markets may lead to anti-competitive practices. Nvidia has been a key player in the rise of AI, supplying the hardware that powers everything from AI research to data centers. However, its growing dominance has caught the attention of regulators who are wary of a monopoly forming in this space.

According to Forbes, the subpoena is part of an ongoing probe, and while specifics remain unclear, it’s believed that regulators are examining Nvidia’s business practices, including its acquisition strategies and its relationships with partners and competitors.

Nvidia is not the first tech company to face antitrust scrutiny. Other major tech firms like Google, Amazon, and Apple have all been under similar investigations, with some resulting in significant fines and changes to their business practices. If Nvidia is found to have violated antitrust laws, the consequences could be severe, ranging from financial penalties to forced restructuring or divestitures.

The Potential Market Impact

As news of the DOJ’s subpoena broke, Nvidia’s stock experienced some volatility. Investors are now grappling with the uncertainty surrounding the investigation, which could have significant ramifications for Nvidia’s business model and future growth.

In the short term, this news may lead to increased market volatility for Nvidia’s stock. However, the long-term implications will depend on the outcome of the investigation. If the DOJ finds that Nvidia has engaged in anti-competitive practices, the company could face regulatory actions that impact its ability to dominate the AI hardware market. On the other hand, if Nvidia successfully defends itself against these allegations, it could emerge even stronger, solidifying its position as a leader in the tech industry.

Traders and investors should keep a close eye on developments in this case, as any significant news could lead to rapid price movements in Nvidia’s stock. It’s also worth monitoring how other tech companies react to this news, as antitrust scrutiny could potentially spread to other players in the industry.

What This Means for the Tech Sector

The DOJ’s probe into Nvidia is part of a broader push by regulators to rein in the power of big tech companies. As the tech sector continues to grow and play an increasingly important role in the global economy, regulators are becoming more vigilant in ensuring that competition remains fair.

For Nvidia, this investigation represents a major hurdle, but it also highlights the importance of its role in the future of AI. The company’s dominance in AI hardware has made it a target for regulators, but it’s also a testament to the significant influence Nvidia holds in shaping the future of technology.

Traders and investors should keep in mind that the outcome of this investigation could set a precedent for how regulators approach antitrust issues in the tech sector. As companies continue to expand and consolidate, it’s likely that we’ll see more regulatory scrutiny in the years to come.

How Traders Should React

As Nvidia faces this new challenge, it’s important for traders to remain informed and stay ahead of market developments. The ongoing investigation could lead to increased volatility in Nvidia’s stock, making it a key opportunity for those trading in the tech sector. However, this also comes with risks, as the outcome of the investigation is far from certain.

For those looking to capitalize on opportunities in the tech sector, it’s crucial to stay informed about the latest market news, price movements, and technical analysis. Understanding the broader market context and regulatory environment will give traders an edge in making strategic decisions.

Take Your Trading to the Next Level with EPIQ Trading Floor

Looking to stay ahead of market movements like this? Join the EPIQ Trading Floor to gain real-time insights, expert market analysis, and access to our exclusive trading community. With our 3-day risk-free trial, you can experience the power of professional trading tools and strategies designed to help you succeed.

Start your 3-day risk-free trial today by clicking here and take your trading to the next level with the EPIQ Trading Floor!

Disclaimer: All content provided in this blog is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.

Responses