Introduction

Decentralized Finance (DeFi) has transformed the traditional financial landscape by allowing individuals to earn passive income without relying on intermediaries like banks. Unlike savings accounts, which offer minimal returns, DeFi lending protocols enable users to lend their cryptocurrency assets and earn competitive interest rates. This approach removes middlemen, creating a more efficient and transparent lending ecosystem while offering significant yield opportunities.

If you’re looking to deepen your understanding of DeFi lending and maximize your earning potential, becoming a member of the EPIQ Trading Floor can be a game-changer. Our members gain access to exclusive trade signals, member-only livestreams, and personalized coaching to help navigate the complexities of crypto trading and passive income strategies. Use code “BLOG” at checkout for 10% off your membership and enjoy a risk-free 3-day trial—cancel anytime within 72 hours without being charged.

Understanding DeFi Lending and How It Works

DeFi lending is a revolutionary financial service that allows cryptocurrency holders to deposit their assets into liquidity pools on decentralized platforms. These pools facilitate borrowing and lending without the need for banks, as smart contracts automate transactions securely and transparently. Borrowers provide collateral to secure loans, while lenders earn interest on their deposits.

This system creates a decentralized alternative to traditional lending, where users retain full control over their assets. Interest rates are determined by supply and demand dynamics within the protocol, meaning that lenders can benefit from attractive yields, often higher than those offered by traditional banks. Some platforms even introduce governance tokens, allowing users to participate in decision-making processes and earn additional rewards.

How DeFi Lending Generates Passive Income

Earning passive income through DeFi lending primarily involves depositing cryptocurrency into lending platforms, where the funds are utilized by borrowers. The return on investment varies based on the asset being lent and the market demand. Some protocols provide variable interest rates, adjusting in real time based on liquidity conditions, while others offer stable interest rates for predictable earnings.

Yield farming has also emerged as a lucrative method to enhance passive income in DeFi. By lending assets, users may receive not only interest but also governance tokens as rewards. These tokens can be staked or sold, adding another layer of profit. Additionally, lending stablecoins such as USDT, USDC, and DAI can offer lower risk while still generating consistent returns, making it an attractive option for those seeking safer investments.

Best DeFi Lending Platforms

Several DeFi platforms dominate the space, each offering unique advantages. Aave, for example, is renowned for its diverse asset support and innovative features like flash loans. It allows users to select between stable and variable interest rates, offering flexibility in their lending strategy. Compound, another major player, employs an automated system that dynamically adjusts interest rates based on liquidity conditions, optimizing returns for lenders. MakerDAO, which operates the DAI stablecoin, enables users to mint new DAI by collateralizing their assets, effectively allowing them to earn passive income in a decentralized manner. Additionally, Curve Finance specializes in stablecoin lending, minimizing volatility risks and making it a preferred platform for those seeking stable returns.

Risks Involved in DeFi Lending

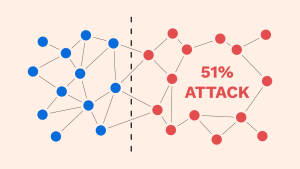

Despite its high yield potential, DeFi lending is not without risks. Smart contract vulnerabilities pose a significant threat, as exploits can result in fund losses. Security audits help mitigate this risk, but the possibility remains. Another major concern is liquidation risk, where borrowers may lose their collateral if its value drops significantly. This event can create instability within lending pools, affecting lenders. Regulatory uncertainties also play a role in the DeFi space, as changing legal frameworks could impact the future of lending platforms. To navigate these risks effectively, lenders should conduct thorough research and consider diversifying their assets across multiple platforms.

Getting Started with DeFi Lending

The first step in DeFi lending is selecting a reputable platform that aligns with your financial goals. Once you choose a platform, setting up a Web3-compatible wallet, such as MetaMask or Trust Wallet, is essential for interacting with the protocol. After funding the wallet with cryptocurrency, you can deposit assets into the platform’s lending pool. Monitoring interest rates and adjusting your strategy accordingly ensures that you optimize your earnings. Additionally, staying informed about market trends and platform updates will help you make informed lending decisions.

Conclusion: The EPIQ Trading Floor Advantage

DeFi lending offers an innovative and lucrative way to earn passive income, but it requires a strategic approach to maximize returns while managing risks effectively. By understanding different lending platforms, monitoring market trends, and optimizing your strategy, you can generate consistent earnings in the evolving crypto ecosystem. However, success in DeFi lending depends on continuous learning and real-time market insights.

For those looking to gain a competitive edge in DeFi lending and crypto trading, EPIQ Trading Floor provides a comprehensive solution. With an exclusive mobile app, expert trade signals, member-only livestreams, and one-on-one coaching, EPIQ members receive the knowledge and resources needed to navigate DeFi and other trading strategies successfully.

Join today and take advantage of our risk-free 3-day trial—explore the platform, access expert insights, and use code “BLOG” at checkout for 10% off your membership. Cancel anytime within 72 hours without being charged and see firsthand how EPIQ can help you maximize your crypto investments.

Disclaimer: The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve significant risks, and you should consult a financial advisor before making any investment decisions.

Responses