The cryptocurrency industry continues to evolve at a rapid pace, and 2025 is shaping up to be another transformative year. With emerging technologies, increasing institutional adoption, and evolving regulations, staying ahead of the trends is crucial for traders and investors. Identifying these trends early can help you position your portfolio to maximize returns and navigate the ever-changing crypto landscape.

In this blog, we’ll explore the top cryptocurrency trends to watch in 2025, supported by actionable insights to guide your trading and investment strategies.

1. Continued Growth in Decentralized Finance (DeFi)

DeFi is one of the fastest-growing sectors in cryptocurrency, and its momentum is expected to continue through 2025. DeFi platforms offer decentralized lending, borrowing, staking, and trading, enabling users to bypass traditional financial institutions.

Key Developments to Watch

- Layer-2 Scaling Solutions: Projects like Polygon and Arbitrum are enhancing DeFi scalability and reducing transaction costs.

- Cross-Chain Compatibility: Bridges between blockchains will allow users to access DeFi opportunities across multiple ecosystems.

- Regulation and Compliance: Governments are starting to regulate DeFi platforms, which could shape their growth trajectory.

Why It Matters

The total value locked (TVL) in DeFi protocols surpassed $200 billion in 2022, and this figure is expected to grow as more users adopt DeFi services, according to DefiLlama.

2. The Rise of Institutional Adoption

Institutional investors are increasingly entering the cryptocurrency space, bringing legitimacy and liquidity to the market. In 2025, this trend is likely to accelerate as more corporations, hedge funds, and asset managers explore blockchain technology and crypto investments.

Key Indicators

- Major companies adding Bitcoin and Ethereum to their balance sheets.

- Launch of cryptocurrency exchange-traded funds (ETFs) in various markets.

- Adoption of blockchain for supply chain management and financial services.

Why It Matters

Institutional adoption enhances market stability and attracts more retail investors, further driving demand for cryptocurrencies.

3. Expansion of Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring digital currencies as a way to modernize their monetary systems. By 2025, several major economies are expected to launch their own CBDCs.

Examples

- China’s Digital Yuan is already in pilot testing phases and gaining traction.

- The European Union is actively developing its own Digital Euro initiative.

- The U.S. Federal Reserve is researching the feasibility of a Digital Dollar.

Why It Matters

CBDCs could increase global adoption of digital assets and provide a gateway for users to transition into cryptocurrencies.

4. NFTs Evolving Beyond Art

Non-Fungible Tokens (NFTs) are expected to expand beyond art and collectibles, finding new applications in gaming, real estate, and identity verification. NFT adoption is poised to grow significantly as their utility diversifies.

Emerging Use Cases

- Gaming: Integration of NFTs in play-to-earn games and metaverse projects.

- Tokenized Real Estate: Fractional ownership of property through NFTs.

- Identity Management: Secure and verifiable digital identities.

Why It Matters

NFTs are projected to become an integral part of the Web3 ecosystem, attracting both creators and consumers.

5. The Role of Artificial Intelligence (AI) in Crypto Trading

Artificial intelligence is increasingly being integrated into cryptocurrency trading tools. AI-powered algorithms can analyze large datasets, identify patterns, and execute trades with precision.

Applications of AI in Crypto

- Trading Bots: Automate buying and selling based on market signals.

- Sentiment Analysis: Monitor social media and news for market sentiment.

- Portfolio Optimization: Maximize returns by adjusting asset allocations.

Why It Matters

AI-driven tools can provide traders with a competitive edge in the fast-moving crypto market.

6. Sustainability and Green Cryptocurrencies

The environmental impact of blockchain technology has been a growing concern. In 2025, sustainability is expected to be a major focus, with projects prioritizing energy-efficient consensus mechanisms.

Green Innovations

- Transition of Ethereum to proof-of-stake (PoS) via Ethereum 2.0.

- Emergence of eco-friendly blockchains like Algorand and Cardano.

- Increased adoption of renewable energy for Bitcoin mining.

Why It Matters

Sustainability initiatives could attract environmentally conscious investors and reduce regulatory scrutiny.

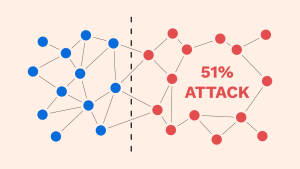

7. Greater Emphasis on Security

As the crypto space grows, so do the risks of cyberattacks and scams. By 2025, the industry will place a stronger emphasis on improving security for users and platforms.

Security Trends

- Wider adoption of hardware wallets like Ledger.

- Development of decentralized identity solutions to prevent fraud.

- Enhanced smart contract audits to reduce vulnerabilities.

Why It Matters

Improved security measures can build trust among users and drive further adoption.

How to Stay Ahead of Crypto Trends in 2025

1. Use Advanced Analytics

The EPIQ Crypto Macro Dashboard provides:

- Real-time market insights.

- Analytics for tracking emerging trends.

- Alerts for significant market shifts.

2. Diversify Your Portfolio

Invest in a mix of established cryptocurrencies, DeFi tokens, NFTs, and green projects to minimize risks.

3. Leverage Educational Resources

Stay informed through trusted platforms and join communities like EPIQ Trading Floor to learn from experienced traders.

How EPIQ Trading Floor Can Help

At EPIQ Trading Floor, we provide the tools and resources you need to stay ahead of the curve:

- Crypto Macro Dashboard: Monitor market trends and identify investment opportunities.

- Expert Guidance: Learn from seasoned traders and improve your strategies.

- Real-Time Alerts: Stay updated on the latest developments in the crypto market.

Sign up today for a 3-day free trial and take the first step toward mastering the crypto trends of 2025.

Conclusion

The cryptocurrency market in 2025 will be defined by innovation, institutional growth, and new use cases that push the boundaries of what blockchain technology can achieve. By staying informed about these trends and leveraging tools like the EPIQ Crypto Macro Dashboard, you can position yourself for success in this dynamic industry.

Disclaimer: The information provided in this blog is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risk, and you should consult with a financial advisor before making investment decisions.

Responses