If you’ve been sitting on the sidelines watching Bitcoin make headlines, you’ve probably asked yourself the million-dollar question:

“Did I miss the boat?”

With Bitcoin already up over 500% from previous cycle lows, and institutions like BlackRock, Fidelity, and major banks getting involved, it’s easy to feel like the opportunity has passed.

But is it really too late to invest in Bitcoin — or are we still early?

Let’s break it down.

📈 What’s the Price of Bitcoin Telling Us?

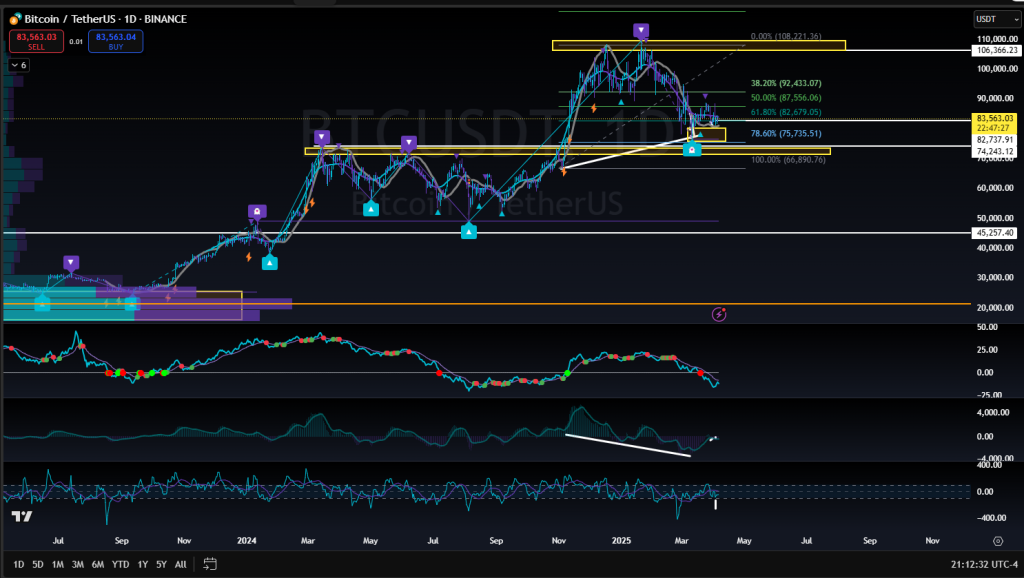

As of this writing, Bitcoin is trading above $70,000, reclaiming its all-time highs and continuing to show strength in the face of global macroeconomic uncertainty.

While some think it’s “overpriced,” it’s important to zoom out.

Bitcoin’s historical trend shows:

- 2011 to 2013 → From ~$2 to ~$1,000

- 2015 to 2017 → From ~$200 to ~$20,000

- 2019 to 2021 → From ~$3,500 to ~$69,000

- 2023 to 2025 → From ~$15,000 to new ATHs (ongoing)

Every cycle, people say “it’s too late”… until it isn’t.

🧠 The Psychology Behind “Too Late”

Thinking you’re too late is often fear in disguise — fear of entering at the top, fear of missing out, fear of looking dumb.

But here’s the truth:

“It’s not about timing the market — it’s about time in the market.”

Bitcoin has continued to reward long-term holders who understand the fundamentals, not just the hype.

🚀 Why It Might Still Be Early

Here are a few reasons why Bitcoin might still have massive room to grow:

1. Institutional Adoption Just Began

Spot Bitcoin ETFs from BlackRock, Fidelity, and others were just approved in 2024.

These institutions manage trillions in assets — and Bitcoin now has a direct pipeline to that capital.

2. Global Supply Is Fixed

There will only ever be 21 million Bitcoin, and over 92% are already mined. With increasing demand and fixed supply, scarcity drives value.

3. Emerging Market Use Cases

From inflation hedges in Argentina and Turkey to remittance solutions in Africa, Bitcoin continues to solve real-world problems — especially in places with unstable currencies.

4. Digital Gold Narrative

As trust in traditional finance wanes, Bitcoin is gaining ground as a store of value. Some analysts forecast BTC hitting $250K+ by the end of this cycle if adoption continues.

🛑 When It Might Be “Too Late”

Let’s be real — there is a time when it’ll be “too late”…

- Too late to catch the explosive growth

- Too late to enter before major regulation

- Too late to accumulate before institutions dominate supply

If you wait until everyone owns it, the upside won’t be asymmetric anymore.

The best time to plant a tree was 10 years ago. The second best time is now.

💡 So… Should You Invest in Bitcoin?

That depends on your:

- Time horizon (Are you thinking 10 days or 10 years?)

- Risk tolerance (Can you handle 30–50% volatility?)

- Understanding of the asset (Do you believe in its long-term value?)

If you believe Bitcoin will be worth more in 3–5 years than it is today — and you’re not trying to trade every swing — it may not be too late at all.

🔐 Final Thought: Stop Timing, Start Learning

Bitcoin is volatile. It’s emotional. It’s not a guaranteed ticket to riches.

But for those who understand the why behind the technology, it’s still one of the most powerful asymmetric opportunities of our time.

Whether it’s too late or still early isn’t the real question.

The real question is:

“Do you understand what you’re investing in?”

🚀 Want to Learn How to Trade & Invest in Bitcoin the Smart Way?

Inside the EPIQ Trading Floor, we’ll help you:

✅ Learn how to analyze the Bitcoin macro cycle

✅ Understand when to DCA, swing trade, or take profits

✅ Get access to real-time trade setups, volume heatmaps & on-chain metrics

✅ Join a community of traders with an 85% win rate over the past 7 months

✅ Attend live calls Tuesdays & Thursdays at 8PM EST for BTC updates

🎯 Start your 3-day free trial now → epiqtradingfloor.com

Don’t follow the hype — follow a plan.

⚠️ Disclaimer:

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investing involves risk. Always do your own research before investing.

Responses