As the cryptocurrency ecosystem continues to evolve, one major challenge remains: the lack of interoperability between different blockchains. Each blockchain operates as its own ecosystem, often isolated from others. This is where cross-chain bridges come into play, enabling seamless interaction and asset transfer between otherwise incompatible blockchains.

In this blog, we’ll explore what cross-chain bridges are, how they work, their importance in the crypto space, and how you can leverage them to maximize your trading and investment opportunities. We’ll also introduce tools like the EPIQ Crypto Macro Dashboard to optimize your cross-chain strategies.

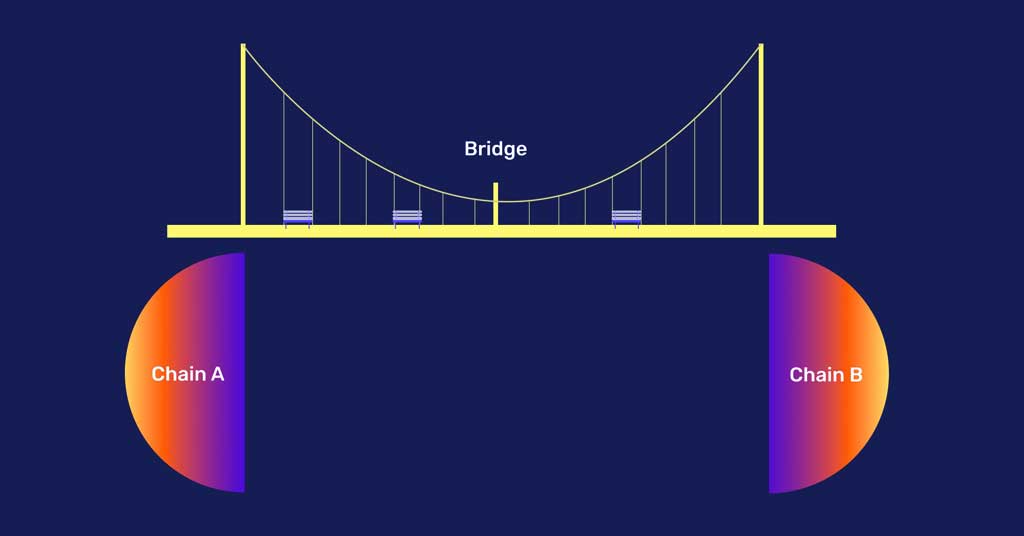

What Are Cross-Chain Bridges?

A cross-chain bridge is a protocol that allows users to transfer assets, data, or tokens between different blockchain networks. These bridges overcome the limitations of individual blockchains, enabling interoperability and facilitating more versatile use cases for cryptocurrencies.

Key Features

- Asset Transfer: Move tokens between blockchains without liquidating them.

- Data Sharing: Share information across chains for dApps and smart contracts.

- DeFi Accessibility: Access decentralized finance (DeFi) opportunities on different chains using the same assets.

For example, a cross-chain bridge can enable a user to move Ethereum (ETH) from the Ethereum network to the Binance Smart Chain, where it can be used in Binance-based applications.

Why Cross-Chain Bridges Matter

1. Interoperability

Cross-chain bridges break down the silos between blockchains, creating a more interconnected ecosystem. This interoperability is crucial for the growth of the crypto industry as it enables greater collaboration and utility.

2. Access to DeFi

Many DeFi platforms operate on specific blockchains. Cross-chain bridges allow users to access DeFi opportunities across multiple ecosystems, such as staking, yield farming, and lending.

3. Increased Liquidity

Bridging tokens between blockchains enhances liquidity, which is vital for robust trading and investment activities. Liquidity increases the efficiency of decentralized exchanges (DEXs) and other financial applications.

4. User Flexibility

Cross-chain bridges provide users with more flexibility in managing their crypto portfolios. Instead of being confined to one blockchain, users can take advantage of multiple ecosystems to optimize returns.

How Do Cross-Chain Bridges Work?

Cross-chain bridges use smart contracts and off-chain mechanisms to facilitate asset transfers. Here’s how they generally work:

- Locking Assets: The original token is locked in a smart contract on the source blockchain.

- Minting Wrapped Tokens: A wrapped version of the token is minted on the destination blockchain. For example, wETH (wrapped Ethereum) represents Ethereum on another blockchain like Binance Smart Chain.

- Burning and Unlocking: When you want to move the token back, the wrapped token is burned, and the original token is unlocked on the source blockchain.

Popular Cross-Chain Bridges

- Polygon Bridge: Transfers assets between Ethereum and Polygon.

- Avalanche Bridge: Connects Ethereum with Avalanche.

- Binance Bridge: Supports interoperability between Binance Smart Chain and multiple blockchains.

Benefits of Using Cross-Chain Bridges

1. Cost Efficiency

Some blockchains, like Ethereum, have high transaction fees. By bridging assets to lower-cost networks, users can save significantly on fees.

2. Enhanced Utility

Bridged tokens can be used in a variety of applications, from DeFi platforms to NFT marketplaces, expanding their utility.

3. Arbitrage Opportunities

Cross-chain bridges allow traders to capitalize on price differences between tokens on different blockchains.

4. Ecosystem Growth

By enabling interoperability, cross-chain bridges promote the development of dApps and smart contracts that leverage multiple blockchains.

Risks Associated with Cross-Chain Bridges

1. Smart Contract Vulnerabilities

As with any blockchain application, cross-chain bridges rely on smart contracts, which are susceptible to bugs and exploits.

2. Centralization Risks

Some bridges are controlled by centralized entities, which may pose security and trust risks.

3. High Transaction Fees

While many bridges aim to reduce fees, some transactions may still incur significant costs, especially during network congestion.

4. Asset Custodianship

In some cases, the original asset is held by a centralized custodian, introducing the risk of mismanagement or loss.

How to Use Cross-Chain Bridges

1. Choose a Reliable Bridge

Select well-established bridges with strong security protocols, such as Polygon Bridge or Avalanche Bridge.

2. Verify Transaction Costs

Before transferring assets, calculate the fees and compare them to ensure cost-effectiveness.

3. Monitor Market Trends

Use tools like the EPIQ Crypto Macro Dashboard to track liquidity and token performance across multiple blockchains.

4. Secure Your Assets

Store your tokens safely with a hardware wallet like Ledger to minimize risks during and after cross-chain transactions.

How EPIQ Trading Floor Can Help

Navigating the complexities of cross-chain interactions requires reliable tools and insights. At EPIQ Trading Floor, we provide:

- Real-Time Analytics: Monitor cross-chain activity and identify opportunities.

- Educational Content: Learn how to leverage cross-chain bridges effectively.

- Macro Dashboard: Use the crypto macro dashboard to track market trends and liquidity.

Sign up for a 3-day free trial today and enhance your cross-chain trading strategies.

Conclusion

Cross-chain bridges are revolutionizing the cryptocurrency space by enabling interoperability, increasing liquidity, and expanding access to DeFi opportunities. While they come with risks, understanding how they work and utilizing the right tools can help you maximize their benefits.

Unlock the full potential of cross-chain trading with the EPIQ Crypto Macro Dashboard and keep your assets secure with trusted wallets like Ledger. Join the EPIQ Trading Floor today and take your crypto strategy to the next level.

Disclaimer: The information provided in this blog is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risk, and you should consult with a financial advisor before making investment decisions.

Responses