Massive 24% Daily Surge Signals Growing DeFi Strength

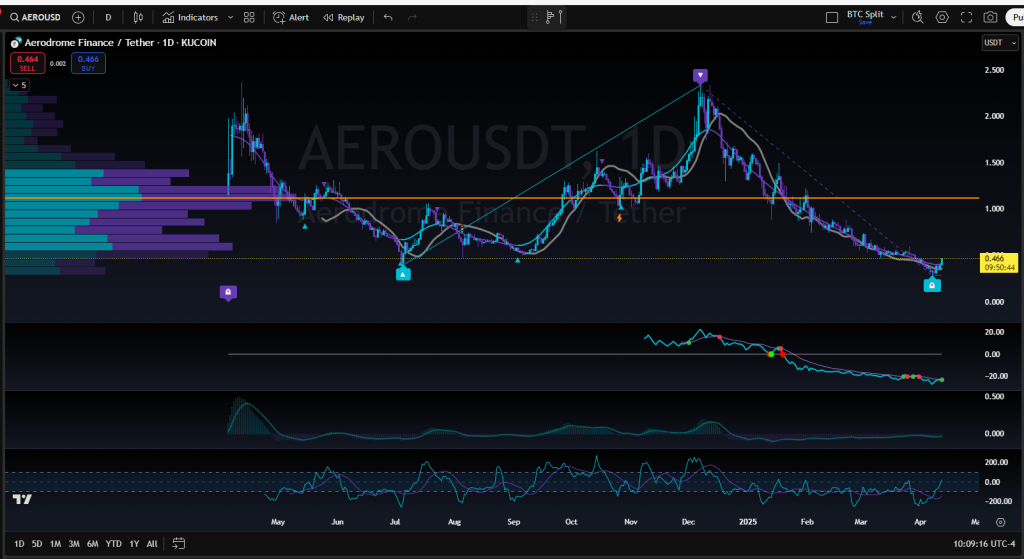

Aerodrome Finance (AERO) has exploded today — up over 24% on the day — making it one of the standout performers across the entire DeFi sector. As of April 12, 2025, AERO is trading at approximately $0.4621, having ripped from lows of $0.365 in the last 24 hours.

This kind of aggressive price action typically catches traders off guard — but it also shows that smart money is starting to rotate back into undervalued DeFi ecosystems, particularly on Base Network where Aerodrome operates.

Price Action & Technical Outlook

AERO has officially broken out of its recent consolidation range. After spending most of the last week grinding between $0.34 – $0.37, today’s move pushed AERO through local resistance at $0.40 and up to test the next key level around $0.465.

This area will be a battleground for bulls and bears over the coming days.

- Immediate Resistance: $0.465 – $0.50

A clean breakout above this zone could send price quickly toward $0.55 – $0.60 which lines up with previous high volume nodes. - Key Support: $0.40 – $0.365

If price fails to hold the breakout and returns to the range, look for buyers to defend this level hard.

Volume & Momentum Signals

The most bullish sign? Volume.

Today’s breakout was not just a wick or a fakeout pump — it was backed by significant daily volume, dwarfing recent trading activity. This typically signals real interest from whales or larger market participants, not retail speculation.

Momentum indicators like RSI are pushing into overbought territory on lower timeframes — but this is expected in breakout environments.

Why Is AERO Pumping?

Several reasons could be driving today’s surge:

- Renewed capital rotation into Base Network projects

- Increased TVL (Total Value Locked) growth in Aerodrome’s DeFi ecosystem

- Stronger narrative positioning around real yield protocols in 2025

- Overall DeFi market waking up after recent pullbacks

AERO has historically been a “low-float, high-beta” play — meaning when money flows into the DeFi sector, it tends to outperform on both the upside and downside.

Final Thoughts & Strategy

AERO’s breakout today is a textbook example of why you want to be positioned before narratives rotate and volume shows up.

That said — chasing strength requires a clear plan.

Watch for:

- Pullbacks to the breakout zone ($0.40 – $0.42) for safer entries

- Confirmation above $0.465 for continuation plays

- Volume profile support levels if price consolidates

This is where patience and technical discipline separate traders from gamblers.

🚀 Want to Learn How to Trade Breakouts Like This?

Inside the EPIQ Trading Academy, we break down setups like this every single day — so you know exactly what to look for before the move happens.

🎯 You’ll learn:

- How to spot breakout patterns before volume hits

- Risk management strategies for volatile assets

- Proven technical analysis frameworks that work across crypto, forex, and stocks

- Lifetime access — one-time payment

- Bonus: 3-Day Free Trial & Certificate upon completion

👉 Join the EPIQ Trading Academy Today and start trading smarter.

Disclaimer: This content is for educational and informational purposes only. It is not financial advice. Always do your own research before making any investment decisions. Cryptocurrency investing involves risk and may result in the loss of capital.

Responses