If you’re serious about timing altcoin rotations, there’s one chart you can’t afford to ignore: Bitcoin Dominance (BTC.D).

BTC.D doesn’t tell you Bitcoin’s price – it tells you how much of the total crypto market cap belongs to Bitcoin.

When you learn to read it, you can anticipate when money is flowing out of Bitcoin and into altcoins, and when it’s rushing back to BTC for safety.

In this guide, we’ll cover:

- What Bitcoin Dominance is (and what it’s not)

- How BTC.D rising or falling impacts altcoins

- The key levels and signals to watch

- How to combine BTC.D with other metrics to catch rotations early

- A step-by-step framework to trade with BTC.D

📊 What Is Bitcoin Dominance?

Bitcoin Dominance is calculated as:

BTC.D = (Bitcoin Market Cap ÷ Total Crypto Market Cap) × 100

If Bitcoin’s market cap is $1.2 trillion and the total crypto market cap is $2 trillion, BTC.D = 60%.

Why it matters: BTC.D acts like a market sentiment gauge.

- Rising BTC.D: More money is flowing into Bitcoin relative to altcoins

- Falling BTC.D: More money is flowing into altcoins relative to Bitcoin

This shift is at the heart of Bitcoin Season vs. Altcoin Season.

🔄 How BTC.D Influences Altcoin Behavior

Here’s the classic relationship:

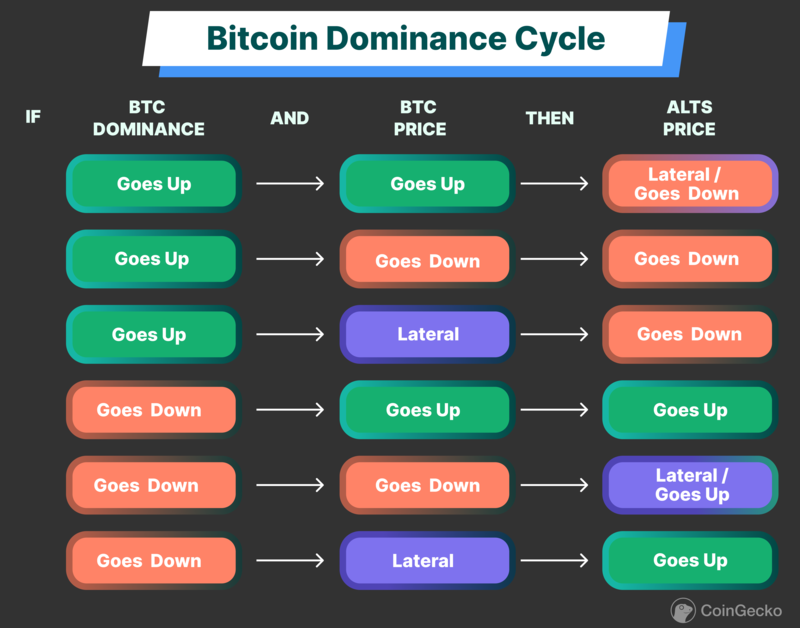

| BTC.D Trend | BTC Price | Altcoin Reaction |

|---|---|---|

| Rising | BTC going up | Alts lag or drop in BTC terms |

| Rising | BTC going down | Alts drop even harder (capital fleeing risk) |

| Falling | BTC going up | Alts outperform (capital rotating to risk) |

| Falling | BTC going sideways | Alts often run hardest |

Example:

If BTC.D falls from 60% to 55% while Bitcoin’s price stays stable, that means altcoins are gaining market share, a prime signal for altseason plays.

📈 Key Levels & Thresholds

Historically:

- Above 60% BTC.D → Bitcoin season, altcoins underperform

- Below 60% BTC.D → Early signs of alt rotation

- Break below 55–52% BTC.D → Full-blown altseason conditions often emerge

Moving averages matter too: A breakdown of BTC.D below its 50-day or 100-day MA often aligns with the start of altcoin rallies.

🧠 Combining BTC.D With Other Metrics

BTC.D works best when paired with:

- $TOTAL2 / $TOTAL3 charts (altcoin market caps excluding BTC and/or ETH)

- Altcoin Season Index – 75%+ of top 50 alts outperform BTC over 90 days often confirms altseason

- Funding rates & Open Interest – spike in alt OI alongside falling BTC.D = high-speculation environment

⚠️ Why BTC.D Going Up Hurts Alts

When BTC.D rises:

- Traders are shifting capital into BTC, not alts

- Risk appetite is lower – altcoins are seen as higher risk

- If BTC is dumping while BTC.D rises, alts usually get hit harder

This is why blindly holding altcoins during rising dominance can destroy a portfolio.

📍 A Practical Trading Framework Using BTC.D

- Identify the Macro Trend

- Daily/weekly BTC.D above 60% = focus on BTC setups

- Below 60% and falling = look for altcoin opportunities

- Look for Breakouts or Breakdowns

- BTC.D breaking key support = alt rotation likely

- BTC.D reclaiming resistance = alt exit signal

- Confirm With Alt Metrics

- Rising $TOTAL3 with falling BTC.D = strong altseason signal

- Use ETH/BTC as a secondary rotation chart

- Time Entries

- Enter alt positions when BTC.D drops and BTC is stable or bullish

- Avoid heavy alt exposure when BTC.D rises

- Set Invalidation Levels

- If BTC.D reverses and reclaims a broken level, cut alt exposure

✅ The Edge BTC.D Gives You

- Liquidity Timing: Shows where capital is flowing

- Risk Awareness: Rising BTC.D = protect capital, falling BTC.D = risk-on

- Cycle Clarity: BTC → ETH → majors → midcaps → microcaps – BTC.D helps you spot the phase

🔥 Want to Master Market Rotations?

At EPIQ Trading Floor, we track BTC.D live alongside:

- ✅ $TOTAL2/$TOTAL3 market cap charts

- ✅ Altseason Index

- ✅ Real-time trade alerts for rotation plays

- ✅ AI-powered analysis to spot early breakouts

👉 Start your 3-day free trial now and use BTC.D like a pro to time when to be in BTC – and when to load up on alts.

Final Thoughts

Bitcoin Dominance is one of the most overlooked tools for traders. If you only watch BTC price, you’re missing the bigger picture: where the money is going.

When BTC.D falls, altcoins are often primed for explosive moves. When it rises, it’s time to be cautious and lean into Bitcoin or stable assets.

Mastering BTC.D can make the difference between catching the start of an altseason and holding a bag while your portfolio bleeds.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

Responses