As of April 1, 2025, Chainlink (LINK) is trading at $14.33, reflecting a modest increase of approximately 0.52% from the previous close. The day’s trading has seen an intraday high of $14.36 and a low of $13.43.

Price Action and Key Levels

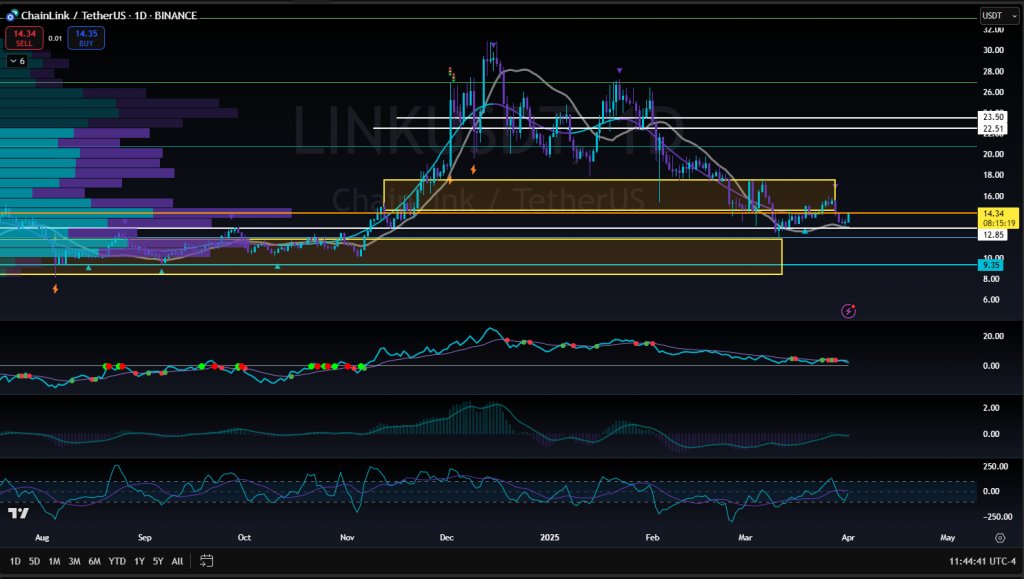

In recent months, LINK has been trading within a descending parallel channel since December 2024. Despite a bounce in mid-March, the price failed to break above the channel’s midline, facing rejection last week. Currently, LINK is positioned in the lower portion of this channel, indicating a cautious market sentiment.

Support Levels:

- $13.69: Immediate support level; a drop below this could lead to further declines.

- $13.12: Secondary support; a breach here may signal a continuation of the bearish trend.

- $12.18: Key support level; holding above this is crucial to prevent significant downturns.

Resistance Levels:

- $15.20: Immediate resistance; overcoming this could indicate a potential reversal.

- $16.14: Secondary resistance; a break above this would strengthen bullish momentum.

- $16.71: Key resistance level; surpassing this may signal a bullish trend continuation.

Technical Indicators

- Relative Strength Index (RSI): The RSI is approaching oversold territory, suggesting that LINK may be due for a short-term bounce.

- Moving Averages: LINK is trading below its 50-day and 200-day moving averages, indicating a bearish trend.

- MACD (Moving Average Convergence Divergence): The MACD line is below the signal line, reinforcing the bearish momentum.

Market Sentiment

The overall market sentiment remains cautious, with traders closely monitoring macroeconomic factors and regulatory developments that could impact LINK’s price trajectory.

Conclusion

Chainlink is at a pivotal point, with its price action suggesting a potential continuation of the bearish trend unless key resistance levels are breached. Traders should monitor the $13.69 support and $15.20 resistance levels closely, as movements beyond these ranges could set the tone for LINK’s short- to medium-term direction.

🚀 Enhance Your Trading Skills with EPIQ Trading Academy!

Stay ahead in the dynamic world of cryptocurrency trading with EPIQ Trading Academy. Our comprehensive courses and resources are designed to equip you with the knowledge and strategies needed to navigate the markets effectively.

What We Offer:

- In-Depth Courses: Covering topics from fundamental analysis to advanced trading strategies.

- Expert Insights: Learn from seasoned traders and industry professionals.

- Community Support: Join a network of like-minded individuals to share insights and strategies.

Ready to Elevate Your Trading?

👉 Join EPIQ Trading Academy Today and take the first step towards mastering cryptocurrency trading!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks, including volatility and potential loss of capital. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Responses