The crypto market is known for its volatility, making trading both thrilling and challenging. However, by using moving averages (MAs), traders can simplify their decision-making process and gain a clearer understanding of price trends. In this blog, we’ll dive into how moving averages work, why they’re a powerful tool, and how to use them effectively in your crypto trading strategy.

What Are Moving Averages?

A moving average is a technical analysis tool that smooths out price data over a specific time period, creating a trend line. This helps traders eliminate the noise of short-term price fluctuations and focus on the bigger picture.

Types of Moving Averages

- Simple Moving Average (SMA):

The SMA calculates the average price of an asset over a set period. For instance, a 20-day SMA shows the average price over the last 20 days. - Exponential Moving Average (EMA):

The EMA gives more weight to recent prices, making it more responsive to recent market changes.

Why Moving Averages Are Effective for Crypto Trading

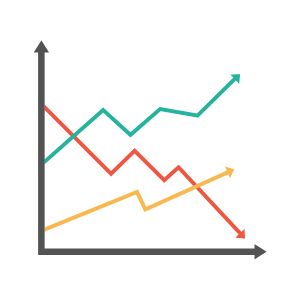

1. Identifying Trends

Moving averages make it easier to spot whether an asset is in an uptrend, downtrend, or trading sideways. For instance, the EMA is widely used to capture short-term momentum in fast-moving markets like cryptocurrency.

2. Defining Support and Resistance

MAs act as dynamic support and resistance levels, where prices often bounce or reverse. This feature provides traders with actionable entry and exit points.

3. Simplifying Trading Decisions

By following MA signals, traders can avoid emotional decision-making. According to a study by Investopedia, trend-following strategies like those involving MAs often outperform in highly volatile markets.

How to Use Moving Averages in Crypto Trading

1. Trend Identification

The slope of the moving average helps identify the trend:

- Uptrend: MAs slope upward.

- Downtrend: MAs slope downward.

2. Crossover Strategy

Crossovers occur when two moving averages with different time periods intersect:

- Golden Cross: A short-term MA crosses above a long-term MA, signaling a potential bullish trend.

- Death Cross: A short-term MA crosses below a long-term MA, signaling a bearish trend.

3. Acting as Dynamic Support/Resistance

- In an uptrend, the MA often acts as support, where prices bounce higher.

- In a downtrend, the MA acts as resistance, where prices face rejection.

Which Moving Averages Should You Use?

For Short-Term Trading

Use fast-moving averages like the 9-day EMA or 20-day EMA for quick entry and exit points.

For Swing Trading

The 50-day SMA and 100-day SMA work well for capturing medium-term trends.

For Long-Term Investing

The 200-day SMA is a popular choice for identifying major market trends.

According to CryptoCompare, using multiple moving averages across different timeframes can significantly improve accuracy in trend identification.

Common Mistakes When Using Moving Averages

1. Relying on MAs Alone

MAs are most effective when combined with other tools like the RSI or MACD.

2. Using the Wrong Timeframes

Ensure your MA settings match your trading style. Short-term traders shouldn’t rely on 200-day MAs, and long-term investors shouldn’t depend on 9-day MAs.

3. Ignoring Market Conditions

MAs work best in trending markets and may provide false signals in sideways or highly volatile markets.

Practical Tips for Getting Started

1. Test Strategies with a Demo Account

Most major exchanges, such as Binance, offer demo accounts for practicing strategies without risking real funds.

2. Backtest Historical Data

Analyze past price data to evaluate how your moving average strategy performs under various market conditions.

3. Learn from Experts

Join trading communities like the EPIQ Trading Floor for real-time insights and guidance.

Why Join the EPIQ Trading Floor?

Trading crypto is easier with the right tools and support. The EPIQ Trading Floor offers:

- Expert Signals: Receive real-time alerts for profitable trades.

- Educational Resources: Learn strategies like moving averages through step-by-step guides.

- Thriving Community: Interact with experienced traders and grow your skills.

💡 Start your journey today with a 3-day free trial!

Conclusion

Using moving averages in crypto trading is a simple yet highly effective way to identify trends, manage risk, and enhance your overall trading strategy. Whether you’re a beginner or a seasoned trader, incorporating MAs can help you make more informed decisions in the volatile crypto market.

Ready to take your trading skills to the next level? Join the EPIQ Trading Floor for exclusive tools, expert guidance, and access to a thriving trading community.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult a professional before making trading decisions.

Responses