If you’ve ever felt blindsided by a random crypto pump…

Or missed the early signs of a major altcoin dump…

It probably wasn’t your chart.

It was your macro awareness.

Most traders only look at price.

But the smart ones?

They look at the big picture — and they look at it every single day.

Here’s why monitoring crypto macro data is one of the most powerful habits you can build as a trader — and how to use our EPIQ Crypto Macro Dashboard to do it in 5 minutes a day.

🧠 What Do We Mean By Crypto Macros?

We’re not just talking about inflation and interest rates (though those matter too).

We’re talking crypto-native macros — the pulse of the entire market:

- 🔄 24H/7D Volume % Change: Are buyers entering or sitting out? Volume reveals everything.

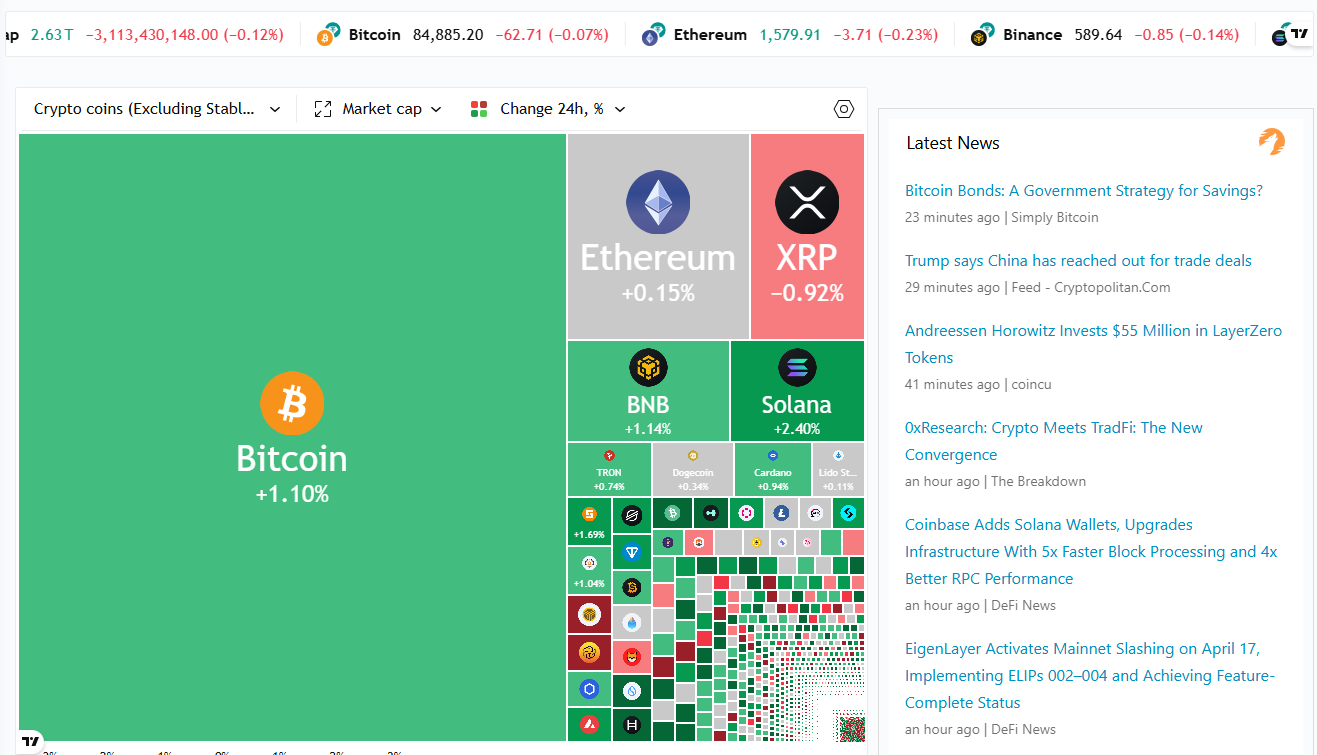

- 💰 Market Cap Trends by Sector: AI, Meme Coins, DeFi — what’s rotating up? What’s bleeding out?

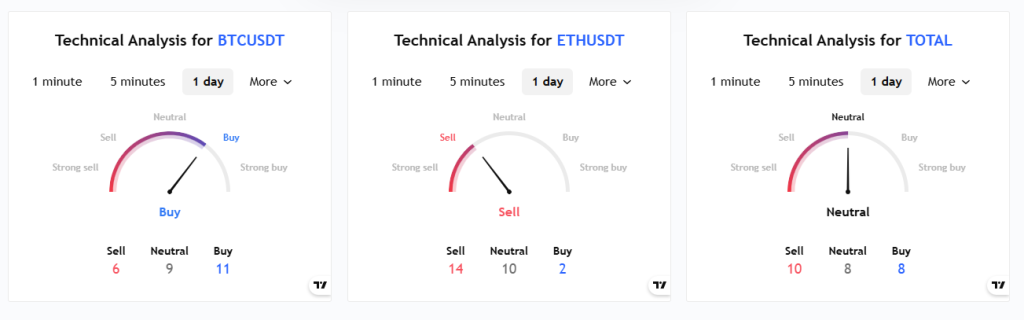

- 📈 Bitcoin & Ethereum Dominance: Is it a BTC-driven move… or are alts leading?

- 😱 Fear & Greed Index: Sentiment tells you when to be cautious — and when to strike.

- 📰 Trending Headlines: What news is moving the market, and how should you play it?

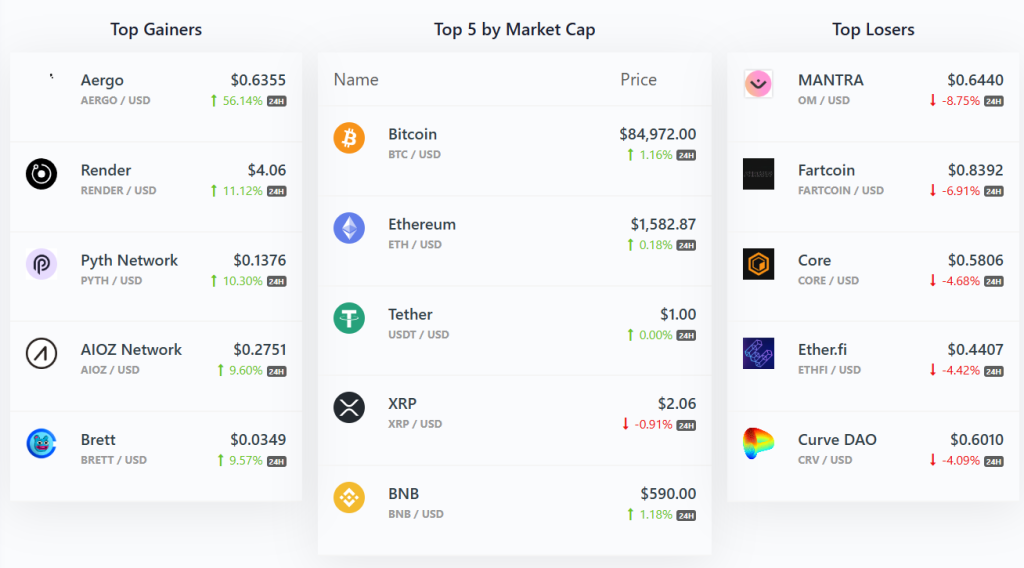

- 🔥 Top Movers / Watchlists: Which coins have momentum? Who’s leading volume increases?

When you look at all of these together, you stop reacting — and start anticipating.

🧭 Why Daily Macro Monitoring Is a Game-Changer

Here’s what happens when you start checking crypto macros daily:

✅ You spot rotations early — Before AI starts trending again… before meme coins lose steam

✅ You align your trades with momentum — Enter the right coins at the right time

✅ You avoid FOMO traps — Real volume > hype

✅ You cut through the noise — Ignore Twitter drama. Trade the real data.

✅ You see what smart money sees — Sector trends, dominance shifts, and sentiment signals

Every major move leaves footprints in macro metrics.

But most traders only look after the move is over.

🔍 Real-Life Example: Missing Altseason By Not Watching Dominance

Let’s say you’re waiting for an altcoin breakout.

But Bitcoin dominance (BTC.D) is surging.

That tells you capital is flowing out of alts and into BTC — the market’s version of “going defensive.”

If you’re watching BTC.D and ETH.D daily, you’ll know:

- When to go heavy on altcoin trades

- When to scale back and focus on BTC or ETH

- When to sideline and wait for confirmation

These macro shifts literally determine whether you’re early or late to every cycle.

📈 Introducing the EPIQ Crypto Macro Dashboard

To help our members stay on top of these shifts, we built the EPIQ Crypto Macro Dashboard — your one-stop shop for understanding the market in under 5 minutes per day.

Here’s what you get:

🧭 24H, 7D, and 30D market performance snapshots

📊 Dominance charts, volume leaders, and top gainers/losers

🔥 Real-time Fear & Greed Index + trend breakdowns

📰 Live headline tracker with trading context

💡 Sector watchlists by category (AI, DeFi, Meme, Infrastructure, etc.)

🔔 Smart alerts for volume spikes, breakouts, and sentiment shifts

This dashboard is your unfair advantage — especially when everyone else is distracted by noise.

🚀 Stop Guessing. Start Tracking. Trade Smarter.

The difference between average traders and elite ones?

It’s not IQ. It’s not even experience.

It’s who’s watching the right data — and who’s just staring at charts.

🎯 Get access to the EPIQ Crypto Macro Dashboard now → epiqtradingfloor.com/crypto-dashboard/

Set yourself up to:

✅ Catch sector trends before they explode

✅ Trade with volume, not vibes

✅ Tune out the noise and follow the numbers

✅ Trade with context, not confusion

Start your free trial and never miss a macro move again.

⚠️ Disclaimer:

This blog is for educational purposes only and does not constitute financial advice. Always do your own research before trading or investing in crypto.

Responses