Blockchain technology is built on trustless systems — but what happens when that trust is compromised by the very network that secures it?

One of the most dangerous — yet widely misunderstood — threats to any decentralized network is a 51% attack.

In this blog post, we’ll break down:

- ✅ What a 51% attack actually is

- ✅ How it works in proof-of-work (PoW) vs. proof-of-stake (PoS) systems

- ✅ Why Bitcoin, despite its size, may be more vulnerable than you think

- ✅ How Ethereum reduced its exposure after The Merge

- ✅ What this means for the future of decentralized networks

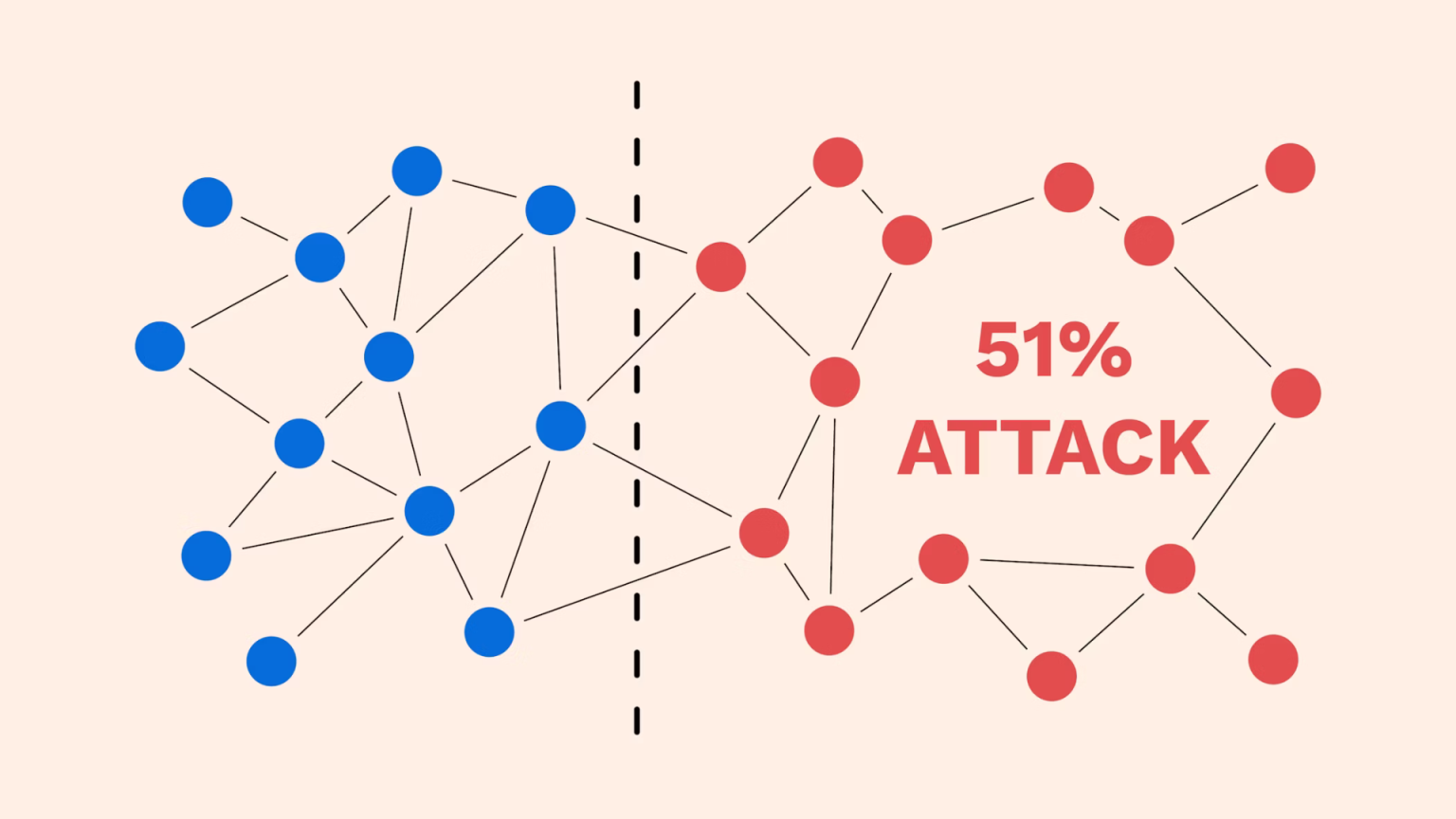

🧠 What Is a 51% Attack?

A 51% attack occurs when a single entity (or group of entities working together) controls more than 50% of a blockchain network’s consensus power — which allows them to:

- Rewrite transaction history

- Double-spend coins

- Prevent other transactions from being confirmed

- Potentially censor or halt the network

It’s not the same as “hacking” the blockchain — instead, it’s taking control of it.

🧱 51% Attacks in Proof-of-Work Systems (Like Bitcoin)

In PoW systems like Bitcoin, miners use computational power to validate transactions and secure the network. The more hash power you have, the more influence you have over the network.

If one party controls 51% or more of Bitcoin’s total hash rate, they can essentially dominate the blockchain.

They could:

- Reverse transactions they made (double spend)

- Block new transactions from being validated

- Undermine trust in the chain’s immutability

This is more than theoretical — Ethereum Classic, Bitcoin Gold, and other PoW chains have all suffered 51% attacks in the past.

🔐 51% Attacks in Proof-of-Stake Systems (Like Ethereum Post-Merge)

Ethereum moved to Proof-of-Stake (PoS) in September 2022 during “The Merge.”

In PoS:

- Validators secure the network based on how much ETH they have staked

- To control the network, you’d need to own or influence 51% of all staked ETH

The cost to launch a 51% attack on Ethereum now:

- Requires billions of dollars in ETH

- Can be slashed (your stake burned) if you misbehave

- Is traceable on-chain

In other words: it’s financially irrational and publicly visible.

This makes Ethereum more resistant to 51% attacks today — not invulnerable, but far more protected than its PoW version or Bitcoin.

⚖️ Why Bitcoin Is Technically More Exposed in 2025

Bitcoin is the most secure blockchain — but ironically, also more exposed to centralized mining threats than Ethereum.

Here’s why:

🧊 1. Mining Is Centralizing

Despite being decentralized in theory, Bitcoin mining is increasingly dominated by a handful of industrial-scale mining pools.

The top 2–3 pools often control 40–45%+ of the hash rate at any given time.

If two pools merged or were coerced by governments, they could surpass the 51% threshold.

🔌 2. PoW Attacks Are Cheaper Than PoS

While expensive, renting or assembling hash power is still cheaper than buying billions of dollars in ETH.

Especially in countries with cheap electricity or subsidized mining operations.

🧱 3. No Slashing or On-Chain Punishment

If someone attacks Bitcoin with 51% of the hash power, there’s no mechanism to slash or burn their resources.

They can shut off their machines and walk away.

On Ethereum, malicious validators can lose their entire staked capital — making it an economically irrational attack.

🧠 Why This Matters for Traders and Investors

The odds of a 51% attack on Bitcoin are low — but they’re not zero.

If one occurred:

- Trust in BTC as “immutable digital gold” would be damaged

- Exchanges could pause withdrawals

- Prices would tank across the market

As a trader, it’s essential to:

✅ Understand the underlying risk behind the blockchains you invest in

✅ Know how governance and validation differ across L1s

✅ Use tools like EPIQ’s news dashboard to monitor critical events or threats

🛠️ What EPIQ Traders Are Doing to Stay Ahead

At EPIQ Trading Floor, we help our members stay prepared by:

📊 Tracking hash rate and validator centralization trends

🧠 Educating members on how attacks could affect price

⚠️ Delivering alerts when key security metrics shift

🎯 Teaching trading strategies that adapt to market structure disruptions

🎯 Want to Learn the Real Risks Behind the Coins You Trade?

Don’t get blindsided by something “under the hood.”

Inside EPIQ, we teach more than just price action — we teach what moves the market at a core level.

You’ll get:

✅ Market psychology

✅ Strategy breakdowns

✅ Security updates

✅ Technical breakdowns on the top coins in crypto

🎯 Start your 3-day free trial now → epiqtradingfloor.com

Because real traders know how to read the price AND the protocol.

⚠️ Disclaimer:

This post is for educational purposes only and does not constitute financial advice. Always do your own research before trading or investing in crypto assets.

Responses