After years of legal uncertainty, Ripple (XRP) has finally emerged victorious as the SEC officially withdrew its lawsuit against the company. This historic decision on March 19, 2025, marks the end of one of the most closely watched legal battles in crypto history. But now that XRP is free from regulatory shackles, what does this mean for traders, investors, and the broader crypto market?

SEC Lawsuit: What Happened and Why It Matters

The SEC filed a lawsuit against Ripple Labs in December 2020, alleging that the company’s sales of XRP constituted an unregistered securities offering. The case dragged on for over four years, causing XRP to be delisted from major exchanges and placing the crypto industry in a regulatory limbo.

The SEC’s official withdrawal of the case on March 19 is a massive win for Ripple and a game-changer for XRP holders. The lawsuit had been a dark cloud over the asset, and with it now cleared, XRP is surging as investors regain confidence in its future.

Market Reaction: XRP Price Spikes and Altcoins Rally

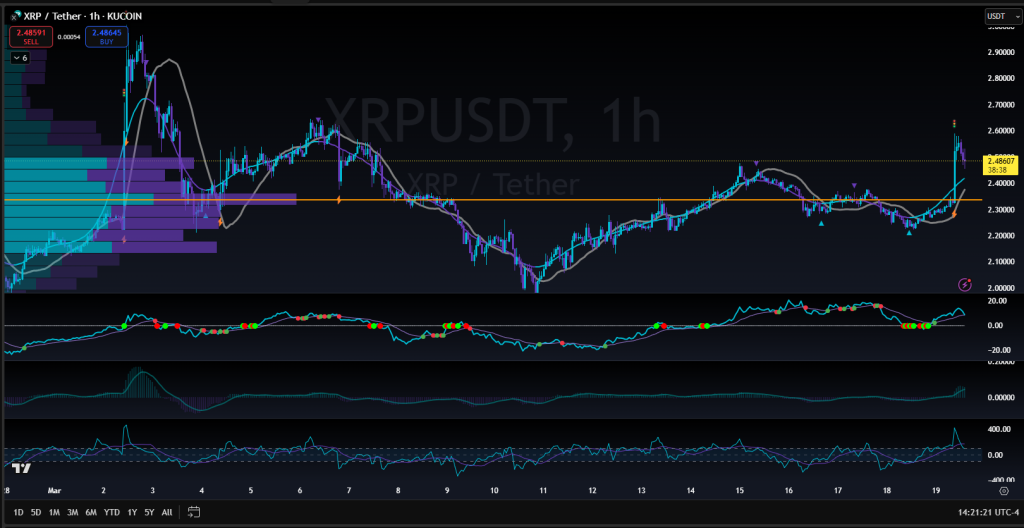

As expected, XRP’s price reacted immediately:

- XRP surged 13% to $2.54 within hours of the announcement.

- Bitcoin (BTC) rose 2.2%, trading at $84,096.

- Ethereum (ETH) jumped 6.6%, reaching $2,031.

This bullish movement signals a potential shift in market sentiment, with some analysts speculating that altcoin season could be heating up. As regulatory uncertainty fades, XRP could see new exchange listings, deeper liquidity, and institutional interest returning.

What’s Next for XRP? Bullish Catalysts to Watch

With the SEC no longer in the picture, XRP’s next moves could be explosive. Here’s what to watch for:

1. Major Exchange Re-Listings

Many exchanges delisted XRP during the lawsuit. Now that the case is closed, exchanges like Coinbase, Kraken, and Binance US could re-list XRP, bringing back billions in potential trading volume.

2. Institutional Adoption

Ripple has strong ties with banks and financial institutions worldwide. With legal clarity, Ripple’s On-Demand Liquidity (ODL) services using XRP could see greater adoption in cross-border payments.

3. Altcoin Market Boom

Historically, XRP has led altcoin rallies when regulatory fears subside. If Bitcoin dominance starts to decline, XRP could be one of the biggest winners in the next altcoin season.

How to Trade XRP Post-Lawsuit: Strategies for Success

While XRP’s outlook is bullish, FOMO-driven rallies can be dangerous. Here are a few tips for traders:

- Don’t Chase Green Candles – XRP’s breakout is strong, but waiting for a healthy pullback before entering can prevent emotional buying.

- Watch for Key Resistance Levels – If XRP pushes past $2.80, it could retest $3.50 and even its all-time high of $3.84.

- Use Proper Risk Management – With regulatory risks fading, volatility remains, so setting a stop-loss and taking profits along the way is key.

🚀 Elevate Your Trading with EPIQ Trading Floor!

Now is the time to capitalize on the biggest market shifts, and EPIQ Trading Floor is here to give you the edge you need.

💡 What You Get Inside EPIQ:

✅ Daily Technical Analysis on XRP and top altcoins 📊

✅ High-Accuracy Trade Signals to maximize profits 📈

✅ Live Strategy Calls with Pro Traders 🔥

✅ 3-Day Free Trial – No Commitments!

👉 Join EPIQ Trading Floor Today and start trading smarter!

⚠️ Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency trading involves risk, and past performance does not guarantee future results. Always conduct your own research before making investment decisions.

Responses