The future of cross-chain payments just got a major upgrade.

Chainlink, the decentralized oracle network powering some of the biggest ecosystems in crypto, has unveiled Payment Abstraction — a next-gen cross-chain payment solution designed to eliminate friction, expand usability, and bring the entire blockchain industry closer to mass adoption.

Whether you’re a trader, a developer, or a DeFi enthusiast, this could be a massive turning point not just for Chainlink, but for how we transact across blockchains.

Let’s break down what Payment Abstraction is, how it works, and what it means for the price of $LINK — and the broader crypto economy.

💡 What Is Chainlink’s Payment Abstraction?

Payment Abstraction is a new system that allows users to pay for Chainlink services using any token — not just LINK.

That means whether you’re using ETH, MATIC, AVAX, stablecoins, or gas tokens, your payment will be automatically converted into LINK behind the scenes.

This process is made possible by combining several of Chainlink’s core technologies:

- Chainlink Automation

- Chainlink Price Feeds

- CCIP (Cross-Chain Interoperability Protocol)

- Decentralized Exchanges (DEXs)

With this tech stack, Chainlink can now seamlessly swap your payment token into LINK, eliminating the need to manually hold and transfer LINK just to access Chainlink oracles.

🔥 Why This Is a Big Deal

✅ 1. No More Token Friction

Before this update, users had to purchase and hold $LINK to interact with Chainlink services. That meant extra steps, extra fees, and added confusion, especially for newer users or enterprise partners.

Now? It’s frictionless. Pay in what you have. Let Chainlink do the rest.

✅ 2. Chainlink Just Became More Developer-Friendly

Developers across all chains can now access Chainlink’s oracles and services without worrying about payment compatibility.

That’s a huge plus for adoption — especially in multi-chain DeFi protocols, gaming, tokenized RWAs, and enterprise integrations.

✅ 3. More Demand for LINK Without Needing to Hold It

The Payment Abstraction system automatically converts user payments into LINK, meaning the buy-side pressure for LINK increases, even if the user never touches the token directly.

This could create consistent backend demand for LINK, similar to how ETH gas is burned in every transaction, driving value long term.

✅ 4. Major Win for Cross-Chain Usability

This update is built on CCIP, Chainlink’s Cross-Chain Interoperability Protocol, which facilitates seamless asset movement between blockchains.

As this system scales, Chainlink could become the payment layer of the multichain world, reducing reliance on centralized bridges and making DeFi truly interoperable.

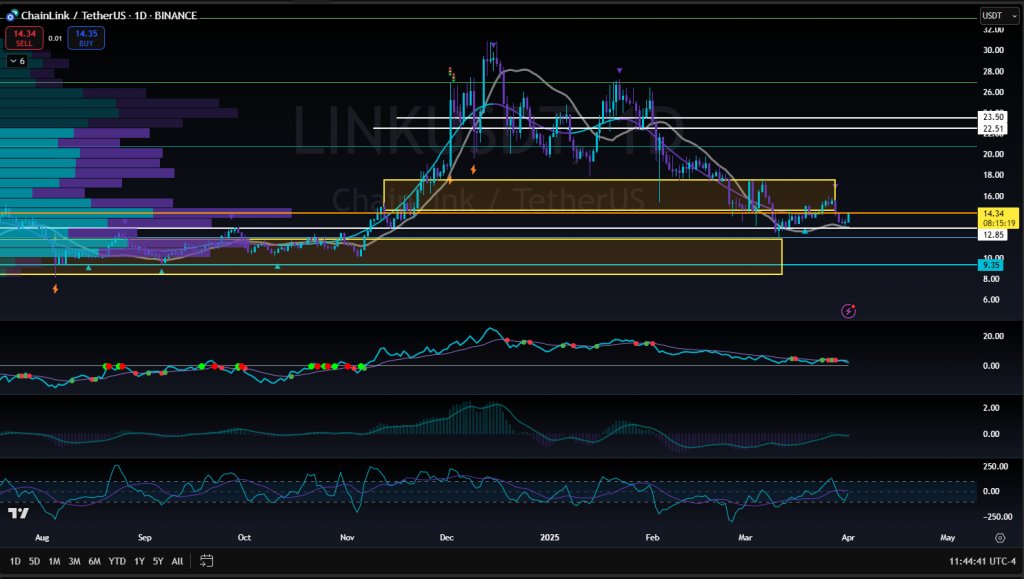

📈 What Does This Mean for $LINK Price?

While crypto markets are still digesting the broader macro landscape, this release positions LINK as one of the most fundamentally sound altcoins heading into the next bull run.

- Real utility

- Passive demand from backend conversions

- A core role in powering multichain infrastructure

- Adoption from enterprise and retail users alike

If the DeFi and RWA sectors continue to grow — and cross-chain usability becomes a priority — LINK may have the strongest upside among legacy altcoins.

🚀 Want to Trade LINK and Other Cross-Chain Leaders Like a Pro?

At EPIQ Trading Floor, we help traders capitalize on high-conviction narratives like this before the rest of the market catches up.

When you join EPIQ, you get:

✅ Real-time trade alerts on LINK, AVAX, and top altcoin narratives

✅ Volume-based analysis, sentiment tracking, and dominance shifts

✅ LMembers only livestreams every Tuesday & Thursday

✅ Smart money breakdowns, macro dashboards, and 85% win-rate trade setups

✅ A community of disciplined traders leveling up together

🎯 Start your 3-day free trial now → epiqtradingfloor.com

Become the trader who actually knows what’s going on.

⚠️ Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any trading or investment decisions. Cryptocurrency markets are highly volatile and involve risk.

Responses