As the world races into a new technological era powered by artificial intelligence, space exploration, and biotechnology, one area of innovation looms over the future of cryptocurrency like a shadow: quantum computing.

Though it’s still early, quantum computers have the potential to break the very encryption standards that protect not only Bitcoin and Ethereum, but the entire digital world. In this blog post, we’ll explore what quantum computing is, how it could compromise cryptocurrency through SHA-256, and what developers are doing to prepare for this future.

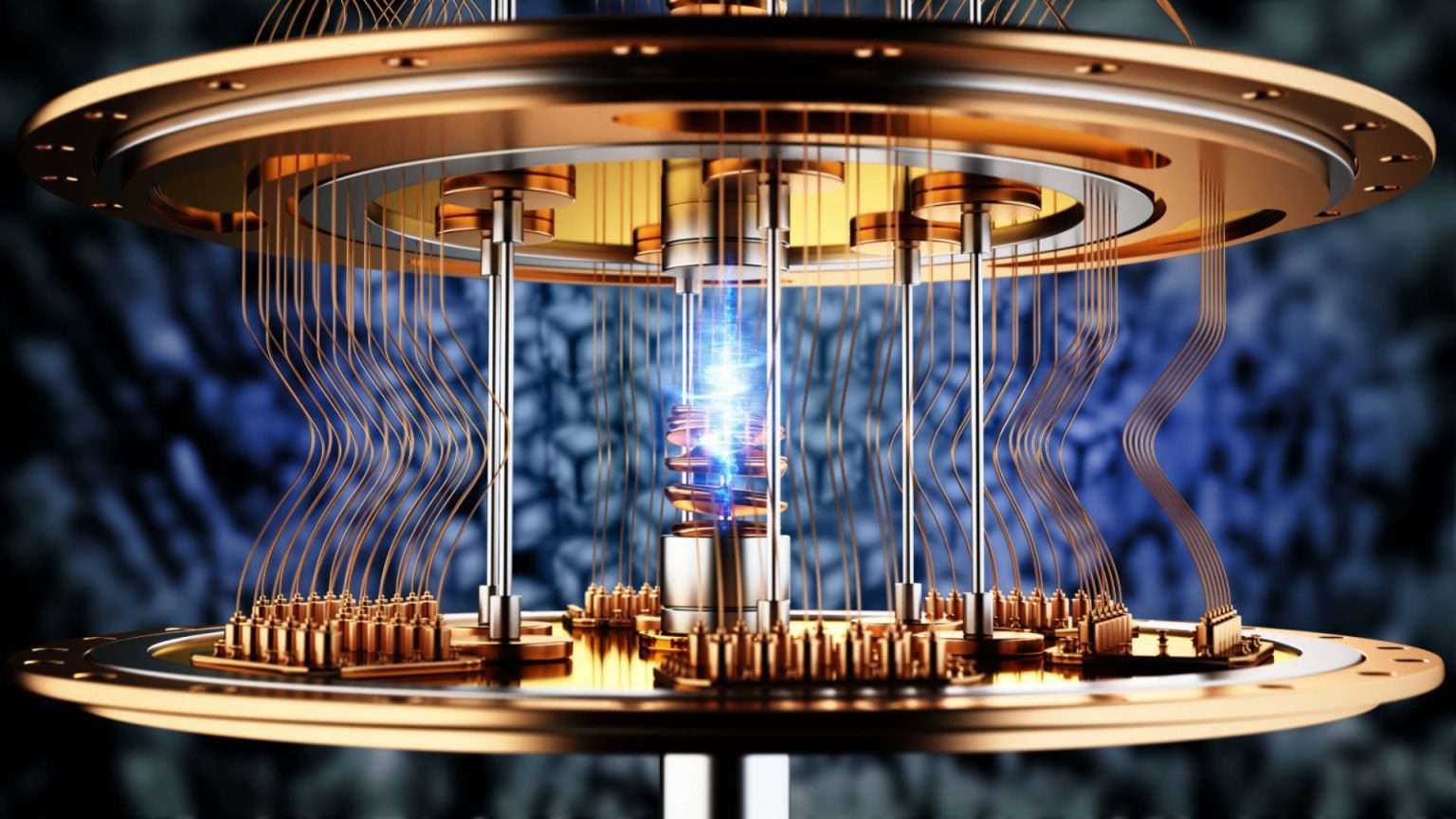

🧠 What Is Quantum Computing?

At its core, quantum computing is a new form of computation that leverages the principles of quantum mechanics—namely, superposition and entanglement. Unlike classical computers, which use bits (0 or 1), quantum computers use qubits, which can exist in both states simultaneously.

This means a quantum computer can perform incredibly complex calculations exponentially faster than today’s most powerful supercomputers. While this offers breakthroughs in medicine, AI, and climate modeling, it also threatens to break encryption as we know it.

🔐 What Is SHA-256 and Why Does It Matter?

SHA-256, or Secure Hash Algorithm 256-bit, is the cryptographic hash function used by Bitcoin (and many other blockchains). It’s a one-way mathematical function that turns any input into a 256-bit string. It is considered virtually impossible to reverse-engineer without a brute-force attack, which would take today’s supercomputers millions of years.

Use cases of SHA-256 in crypto:

- Mining: Solving SHA-256 hash puzzles to validate blocks

- Wallet addresses: Public keys are hashed with SHA-256

- Transaction integrity: Ensures data hasn’t been tampered with

But what if a computer could break it instantly?

⚔️ Why Quantum Computers Threaten SHA-256

A sufficiently powerful quantum computer could use Shor’s algorithm to efficiently factor large integers, something current computers can’t do quickly. This would allow it to:

- Reverse private keys from public keys

- Forge transactions and redirect funds

- Undermine mining by instantly solving hashes

This is not a sci-fi script. Leading researchers have suggested that a quantum computer with around 2,500 stable qubits could, in theory, break Elliptic Curve Digital Signature Algorithm (ECDSA), used by Bitcoin for transaction signing.

While SHA-256 is technically more quantum-resistant than ECDSA, it’s not quantum-proof. And once ECDSA falls, wallets with exposed public keys become vulnerable, even those that haven’t moved funds in years.

⏳ Timeline: When Will This Happen?

As of mid-2025, we are still in the early stages of quantum development. The most powerful quantum processors today (like IBM’s Condor or Google’s Sycamore 2) are in the hundreds of qubits, well below the threshold needed to break Bitcoin.

Experts estimate a 10–15 year runway before we reach “quantum supremacy” that could realistically crack current cryptography. But the threat is real enough that national governments, including the U.S. NSA, are already preparing for it.

🧬 Post-Quantum Cryptography (PQC): The Arms Race Begins

Crypto developers and blockchain researchers are not sitting still. There’s already a movement toward post-quantum cryptographic algorithms, which are designed to be safe from quantum attacks.

Projects like:

- QRL (Quantum Resistant Ledger): The first blockchain to implement post-quantum signatures

- ETH 3.0 proposals: Researching new signature schemes like STARKs and Lattice-based cryptography

- Bitcoin Core devs: Considering Schnorr signatures and other alternatives

A soft fork or hard fork may be necessary in the future to transition major chains to quantum-resistant models. This could also be a major event in crypto’s history, similar to the SegWit update or Ethereum’s move to Proof of Stake.

🤯 Why This Matters for Investors and Traders

Even if the quantum threat is still years away, the implications for long-term holding strategies (like HODLing) are massive:

- Lost wallets with public keys visible are most vulnerable

- Smart contracts with legacy encryption could be exploited

- Early proactive projects may outperform in the long run

Investors should begin to research quantum-resilient assets, stay aware of project updates, and avoid keeping large holdings in wallets that have been publicly exposed.

✅ Key Takeaways

- Quantum computers could theoretically break current blockchain encryption methods

- SHA-256 and ECDSA are not quantum-proof

- The risk is long-term, but action is needed today

- Post-quantum cryptography is in active development

- Traders and investors should monitor which projects adapt fastest

🚀 Ready to Stay Ahead of the Crypto Curve?

Quantum risk is just one of many market-changing forces. The real edge comes from understanding macro events, mastering volume strategies, and staying educated in real time.

That’s exactly what we offer at the EPIQ Trading Floor:

✅ A crypto academy designed for all levels (Section 1 is free)

✅ Real-time trade alerts, macro dashboards, and 24/7 support

✅ A growing community of sharp traders preparing for every market phase

👉 Join us now for a 3-day free trial and start trading smarter today:

🔗 epiqtradingfloor.com

⚠️ Disclaimer:

This blog post is for informational purposes only and should not be considered financial advice. Always do your own research (DYOR) and invest responsibly.

Responses