As crypto adoption accelerates in 2025, one question becomes more important than ever:

“Where should I store my crypto — and is it safe?”

With hacks, exchange collapses, and phishing attacks still common, how you store your assets is just as important as what you’re investing in.

In this guide, we’ll cover:

- ✅ The difference between hot, cold, and hardware wallets

- ✅ Why storage type matters based on how you use crypto

- ✅ Centralized exchanges (CEXs) vs decentralized exchanges (DEXs)

- ✅ The safest storage strategy for traders and long-term holders

- ✅ How we handle secure trading setups inside EPIQ Trading Floor

Let’s break it all down.

🧠 Why Storage Matters in Crypto

When you own crypto, you’re not just holding an asset — you’re holding a private key that gives you access to that asset.

If someone gets your private key, your funds are gone.

If you lose it, there’s no customer support to help you recover it.

This is why choosing the right storage method is critical.

🔥 Hot Wallets: Fast, Flexible, But Riskier

Hot wallets are wallets connected to the internet.

Examples:

- MetaMask

- Trust Wallet

- Phantom (for Solana)

- Exchanges like Coinbase or Binance

Pros:

- Easy to use

- Ideal for frequent trading, DeFi, or NFT interaction

- Fast access to funds

Cons:

- Always online = vulnerable to hacks and phishing

- If browser or device is compromised, your wallet could be too

Best For:

Active traders, DeFi users, and short-term crypto holders

🧊 Cold Wallets: Secure, But Slower

Cold wallets are completely offline storage solutions.

Examples:

- Paper wallets (printed QR codes/private keys)

- Air-gapped wallets

- Hardware wallets kept disconnected

Pros:

- Completely immune to online hacks

- Ideal for long-term HODLing

Cons:

- Less convenient for regular use

- Risk of physical loss or damage

Best For:

Long-term investors holding BTC, ETH, and other major assets

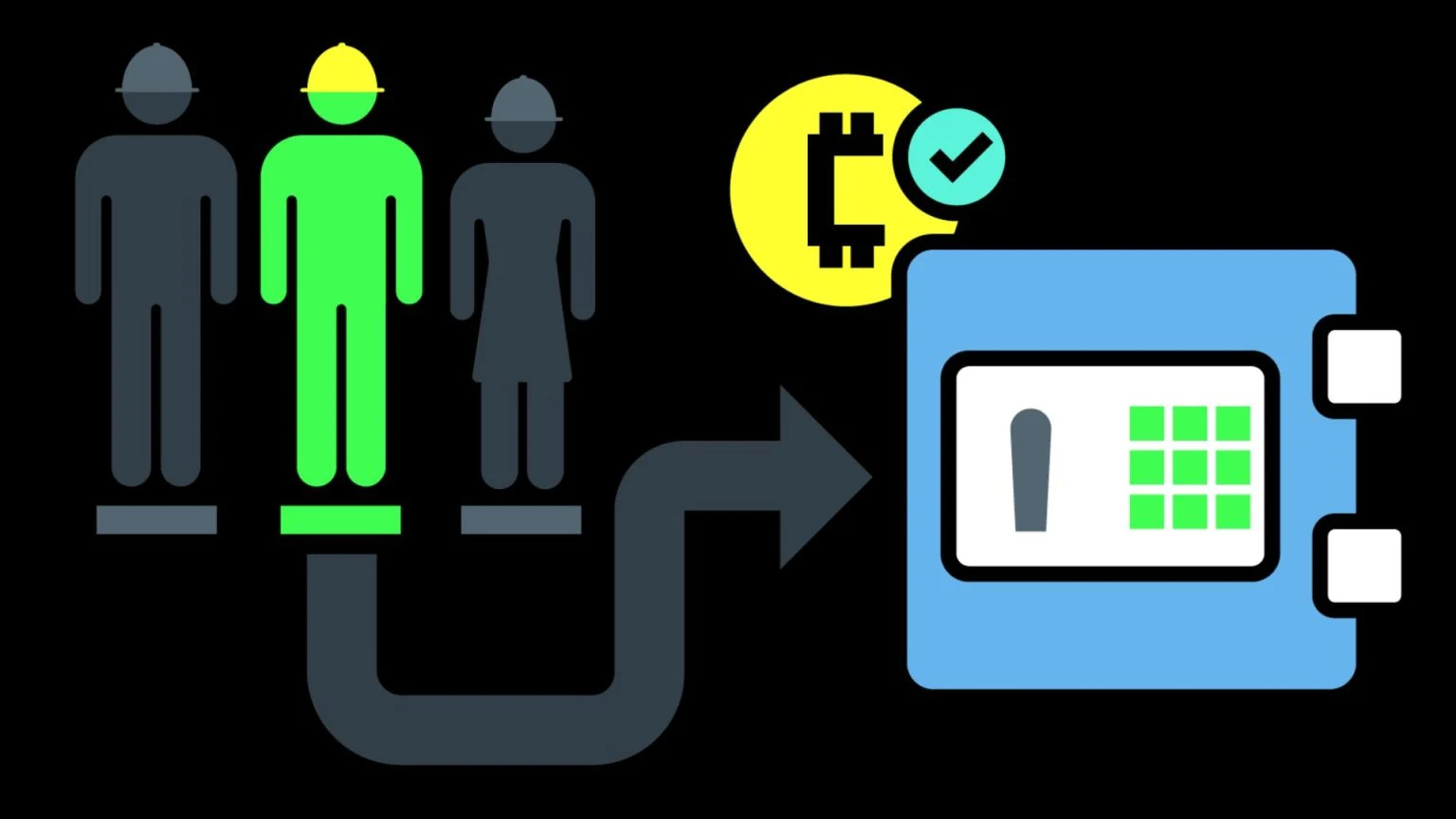

🔐 Hardware Wallets: The Best of Both Worlds

Hardware wallets are physical devices (like USB drives) that store your private keys offline, but can connect to the internet when needed.

Examples:

Pros:

- Extremely secure

- You sign transactions from the device — your keys never touch the web

- Ideal balance of usability and safety

Cons:

- Costs $70–$300

- If you lose your recovery phrase, you could lose access forever

Best For:

Anyone serious about security, especially for long-term wealth protection

🏛️ CEX vs DEX: Where Are You Buying and Selling Crypto?

How you store crypto also depends on where you trade it.

Let’s break it down.

🏢 Centralized Exchange (CEX)

Examples: Binance, Coinbase, Bybit, Kraken

Pros:

- Easy onboarding for beginners

- Fiat on-ramps

- High liquidity

- Customer support

Cons:

- Not your keys = not your crypto

- Can be hacked (FTX, anyone?)

- Subject to regulations, seizures, or downtime

🌐 Decentralized Exchange (DEX)

Examples: Uniswap, 1inch, SushiSwap, PancakeSwap

Pros:

- You control your wallet and keys

- Fully on-chain and non-custodial

- Often have access to newer tokens

Cons:

- No customer service

- More room for user error

- Higher gas fees on some chains

- Scams and fake tokens more common

🛠️ What’s the Best Storage Strategy?

There’s no one-size-fits-all — but here’s what we recommend:

🧠 For Traders:

- Hot wallet (e.g. MetaMask) for small, active positions

- Keep your core capital in a hardware wallet

- Use exchanges you trust, but withdraw when not actively trading

🧠 For Long-Term Investors:

- Hardware wallet or cold storage only

- 2 backups of your recovery phrase in different secure locations

- Avoid keeping funds on exchanges unless actively using them

🧩 How We Handle Security Inside EPIQ

At EPIQ Trading Floor, we emphasize risk management and self-custody as much as strategy.

Here’s how we help our members stay safe:

📚 Trading Academy — Teaches best practices for wallet setup, phishing protection, and secure DeFi usage (Section 1 is free)

🔐 Cold storage recommendations — What wallets to use and how to manage recovery phrases

📈 Real-time trade alerts — You trade smarter, which means you don’t need to leave assets exposed

🧠 Live strategy calls — Cover security protocols, safe staking, bridging risks, and more

🚀 Final Thoughts: Don’t Just Focus on Gains — Protect Them

Crypto can offer insane upside — but only if you keep your assets secure.

Too many people lose their bags not because of bad trades… but because of bad storage.

🎯 Treat your crypto like digital gold.

Choose the right wallet for your goals.

And make sure you, not the exchange, control your keys.

🎯 Want Help Trading, Securing, and Growing Your Crypto Portfolio?

Inside EPIQ Trading Floor, we give you:

✅ Education on safe self-custody and risk management

✅ Real trade setups — so you’re not just holding, but growing your stack

✅ Tools to evaluate exchanges, wallets, and staking platforms

✅ Weekly calls that break down how to thrive and survive in crypto

🎯 Start your 3-day free trial now → epiqtradingfloor.com

Be smart. Be early. Be secure.

That’s the EPIQ way.

⚠️ Disclaimer:

This blog is for educational purposes only and does not constitute financial advice. Always do your own research before using exchanges, wallets, or custody services.

Responses