Bitcoin was once called the “digital gold” — a hedge against inflation, banking instability, and government overreach. But in today’s volatile market, with recession fears rising and economic data flashing warnings, one question keeps coming up:

“Is Bitcoin still a true safe haven… or has it become just another risky bet?”

The answer might surprise you — and it’s critical for traders to understand as we move deeper into 2025.

🧠 Bitcoin’s Original Thesis: Decentralized Protection

When Bitcoin was created in 2009, it was literally born out of an economic crisis. The message embedded in Bitcoin’s first block referenced bank bailouts during the Great Recession — a symbolic rejection of centralized financial failure.

For over a decade, Bitcoin has been pitched as an alternative:

- A store of value immune to money printing

- A decentralized escape from traditional banking systems

- A digital hedge against inflation and economic collapse

But as the market matures, the way Bitcoin behaves in crises is changing — and traders need to adapt.

📊 How Bitcoin Has Reacted in Recent Economic Stress Events

1. March 2020 (COVID crash)

Bitcoin crashed over 50% alongside equities, gold, and virtually every risk asset.

Why? Liquidity crunch — in true crises, people sell everything for cash.

2. 2022 (Inflation + Fed tightening)

Bitcoin dropped from $69,000 to $16,000 as central banks raised interest rates aggressively.

Why? Higher interest rates made risk-free assets more attractive than speculative ones.

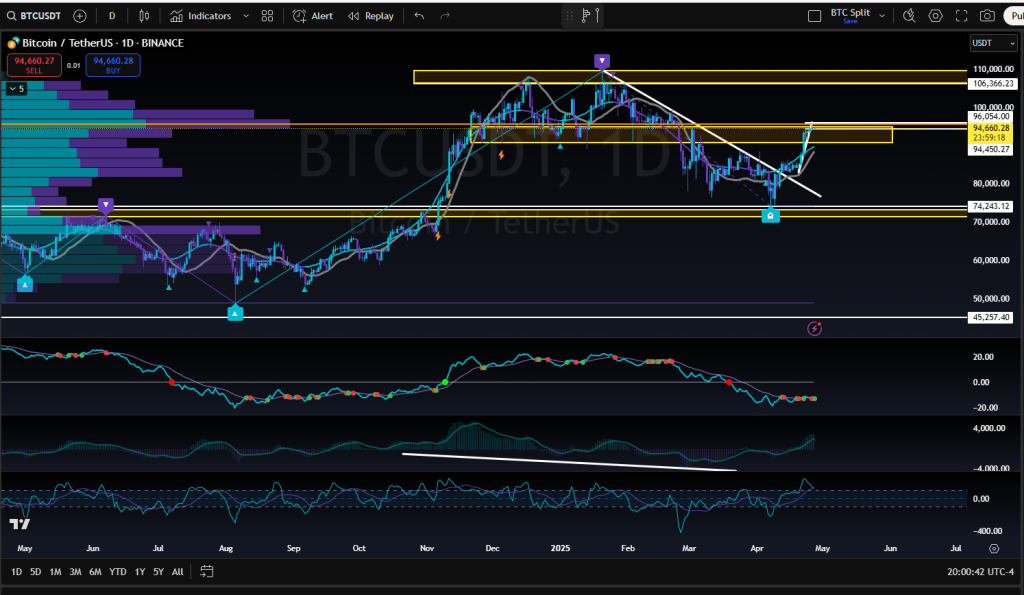

3. 2024–2025 (Current environment)

Despite inflation, geopolitical tensions, and banking uncertainty, Bitcoin has rebounded sharply — and is now behaving more like gold than in prior crashes.

What’s changed?

- Institutional adoption via ETFs (new “diamond hands”)

- Broader recognition of Bitcoin as a hedge, not just a tech bet

- Liquidity support from emerging markets and sovereign wealth funds

🔥 Bitcoin: Hedge or Risk Asset in 2025?

Short-term:

In liquidity crises, Bitcoin still behaves like a risk asset — it gets sold when investors need immediate cash.

Long-term:

Bitcoin continues to behave more and more like a macro hedge against inflation, currency debasement, and centralized risk.

Key takeaway:

Bitcoin is not a perfect short-term hedge.

It’s a long-term asymmetric bet on decentralized money.

📈 How to Position Yourself as a Trader

- If you’re a short-term trader: Treat Bitcoin like a high-volatility asset. Respect key support/resistance zones and news-driven liquidity shifts.

- If you’re a long-term investor: Focus on accumulation zones during fear-driven dips, not during parabolic euphoria.

Patience wins in Bitcoin — not panic.

🚀 Want to Trade Bitcoin the Smart Way?

If you’re tired of chasing pumps and FOMOing late, you need real strategies.

Inside the EPIQ Trading Floor, we teach:

✅ How to understand Bitcoin’s true market cycle behavior

✅ How to use volume and macro data to find ideal entries

✅ How to manage risk like a professional trader

✅ Lifetime access + private community + 3-day free trial

👉 Join the EPIQ Trading Floor Today and start trading like the top 5%, not the guessing 95%.

⚠️ Disclaimer: This post is for educational purposes only and is not financial advice. Cryptocurrency investments are volatile and carry risk. Always do your own research and consult a licensed financial advisor before investing.

Responses