Navigating the cryptocurrency market can be challenging, especially with thousands of coins and tokens available for investment. One critical component that investors often overlook is the concept of tokenomics—the economic foundation behind every crypto project. Understanding tokenomics can help investors identify healthy, sustainable crypto projects that stand a better chance of succeeding long-term.

If you’re looking to deepen your crypto market knowledge and elevate your trading performance, consider joining EPIQ Trading Floor. As a member, you’ll gain exclusive access to expert trade signals, member-only livestreams, and personalized coaching sessions. Start your risk-free, 3-day trial today—use the discount code “BLOG” at checkout for 10% off and cancel anytime within the first 72 hours without being charged.

What Exactly is Tokenomics?

Tokenomics—a fusion of “token” and “economics”—refers to the set of rules, features, and structures that define a crypto token’s economic model. It covers aspects like token supply, distribution, inflation rate, incentives, and overall utility within a project’s ecosystem. Good tokenomics aligns the interests of users, investors, and developers, fostering healthy growth and sustainable demand for the token.

According to CoinGecko, solid tokenomics can significantly influence the long-term valuation and success of a cryptocurrency, affecting everything from its adoption to its resilience during market downturns.

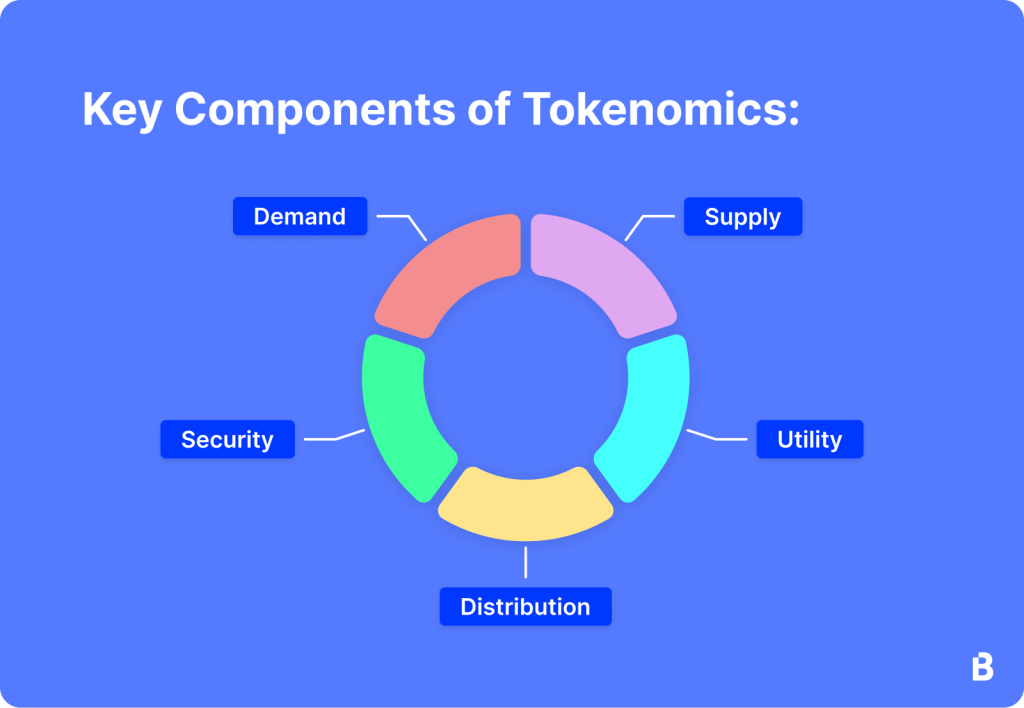

Key Factors to Assess in Tokenomics

When evaluating a crypto project’s tokenomics, there are several essential factors to consider:

Total Supply and Circulating Supply

The first step is examining the total and circulating supply of tokens. Total supply refers to the maximum number of tokens that will ever exist, whereas circulating supply is the current amount available to the market. Tokens with limited or capped supplies, like Bitcoin (capped at 21 million coins), often experience increased demand, potentially leading to higher valuations over time.

Conversely, tokens with excessively large or uncapped supplies may face inflationary pressures that devalue individual tokens. Understanding this relationship is essential for making informed investment decisions.

Token Distribution

The initial distribution of tokens is another critical factor. Healthy tokenomics involve a transparent distribution that avoids excessive concentration in the hands of founders or private investors. Projects with a significant percentage of tokens allocated to the community and public investors typically enjoy greater trust, reduced price manipulation, and higher decentralization.

For example, Ethereum’s distribution model involved a public sale where the majority of tokens were fairly distributed among thousands of participants, helping to ensure long-term ecosystem stability.

Utility and Purpose

The token’s utility—the practical uses it offers within its ecosystem—is paramount. Tokens with clear, practical use cases tend to retain value better. Utility tokens are typically required for platform services, governance decisions, or staking rewards. A well-designed token incentivizes continuous holding and use, reducing selling pressure and maintaining steady demand.

Take, for example, governance tokens like Uniswap’s UNI token, which empowers holders with voting rights on key protocol decisions, directly influencing its utility and community engagement.

Inflationary vs. Deflationary Models

Understanding whether a token is inflationary or deflationary helps investors gauge potential future value. Inflationary tokens continuously increase in supply, potentially diluting value if demand doesn’t keep pace. However, moderate inflation can also incentivize participation and usage.

Deflationary tokens, on the other hand, reduce their supply over time, usually through token burns or buybacks, potentially driving up token prices if demand remains stable or increases. Binance Coin (BNB) is an example of a deflationary token, regularly conducting token burns that effectively reduce its circulating supply and positively impact its market value.

Incentive Structures and Staking Rewards

Good tokenomics incorporate attractive incentive mechanisms that encourage user engagement and loyalty. Rewarding token holders through staking, yield farming, or liquidity provision helps to foster active participation and reduce token sell-offs. Investors should seek projects that transparently communicate these incentive mechanisms, as this can significantly influence long-term sustainability.

For instance, projects like Cardano and Solana offer staking rewards to holders, incentivizing long-term holding and participation in network governance.

Red Flags to Avoid in Tokenomics

While identifying positive elements is vital, recognizing red flags is equally important. Watch out for projects with disproportionately large allocations reserved for founders or insiders, as these can indicate a risk of sudden sell-offs. Additionally, vague or overly complex tokenomics without clear use cases should raise concerns about long-term viability. Lastly, aggressive inflation schedules without matching growth or utility can lead to continuous value erosion.

Tools and Resources for Tokenomics Analysis

Platforms like CoinGecko, CoinMarketCap, and official project whitepapers offer valuable insights into tokenomics. These resources provide data on token supply, distribution, inflation rates, and detailed information about incentive mechanisms and utility. Utilizing these platforms regularly as part of your research process can significantly enhance your investment decisions.

Final Thoughts: Level Up Your Crypto Investing with EPIQ Trading Floor

A thorough understanding of tokenomics is critical for spotting healthy, sustainable crypto projects. Good tokenomics ensures alignment between token holders, developers, and community members, promoting stable growth and reducing the risk of sudden devaluations.

If you’re serious about improving your cryptocurrency trading skills, gaining access to actionable market insights, and making informed decisions, consider becoming a member of the EPIQ Trading Floor. Our Members’ Only access offers an exclusive mobile app, real-time trade signals, private livestreams with experienced traders, and personalized one-on-one coaching.

Sign up today and use code “BLOG” at checkout to receive a 10% discount on your membership. Try all our premium resources with a risk-free 3-day trial—cancel anytime within the first 72 hours without being charged. Equip yourself with the tools and knowledge to become a successful trader.

Disclaimer:

This article is provided for educational purposes only and does not constitute financial or investment advice. Cryptocurrency trading involves substantial risk, and investors should always conduct thorough research or consult with a financial advisor before investing.

Responses