Futures trading is a dynamic and often unpredictable market. To achieve consistent success, traders must utilize effective tools and strategies. One such strategy is Fibonacci retracements, a technical analysis tool that helps identify potential levels of support and resistance. In this blog, we’ll explore how to use Fibonacci retracements in futures trading and why this method can help you achieve consistent wins.

What Are Fibonacci Retracements?

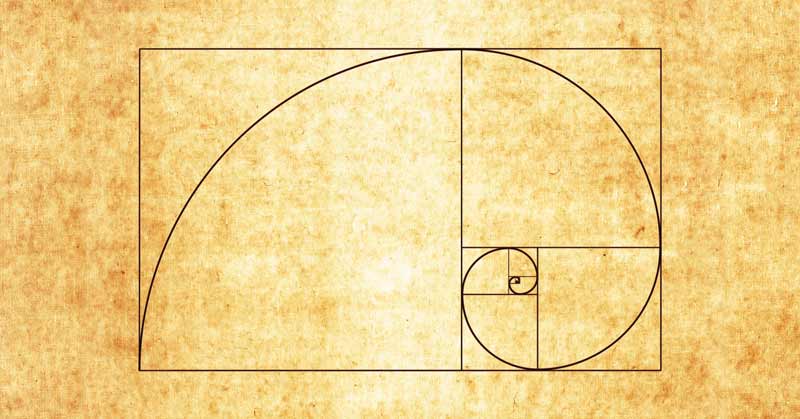

Fibonacci retracements are a technical analysis tool based on the Fibonacci sequence, a mathematical pattern found in nature. In trading, these retracement levels are used to identify potential reversal points in price movements. The most commonly used Fibonacci levels are 23.6%, 38.2%, 50%, 61.8%, and 100%.

How Fibonacci Retracements Work

- Identify a Trend: Determine whether the market is in an uptrend or downtrend.

- Draw the Retracement Levels: Use the high and low points of the trend to plot Fibonacci levels.

- Analyze Price Action: Look for potential support and resistance zones at these levels.

For example, if a futures contract is in an uptrend and begins to pull back, Fibonacci levels can help predict where the price might reverse and continue upward.

Why Use Fibonacci Retracements in Futures Trading?

1. Identify Key Levels

Fibonacci retracements highlight critical support and resistance levels, helping traders make informed decisions.

2. Enhance Risk Management

Using these levels, you can set stop-loss and take-profit orders more effectively.

3. Combine with Other Indicators

Fibonacci retracements work well with other technical tools, such as moving averages or RSI, to confirm trading signals.

Benefits of Fibonacci Retracements

- Versatility: Applicable to any market, including commodities, indices, and currencies.

- Simplicity: Easy to use, even for beginners.

- Precision: Helps identify precise entry and exit points.

Limitations of Fibonacci Retracements

- Subjectivity: Results can vary based on how traders draw the retracement levels.

- Market Dependency: They may be less effective in highly volatile or trendless markets.

Real-World Application of Fibonacci Retracements

According to Investopedia, Fibonacci retracements are widely used by professional traders to identify profitable opportunities in futures and forex markets. For instance, during a bullish trend in crude oil futures, traders often use the 61.8% retracement level to predict potential buying opportunities.

Tips for Using Fibonacci Retracements Effectively

- Use Multiple Timeframes: Analyze Fibonacci levels on different timeframes to gain a comprehensive view of the market.

- Combine with Other Tools: Confirm Fibonacci signals with other indicators like MACD or trendlines.

- Practice Discipline: Stick to your trading plan and avoid impulsive decisions.

Leverage Expert Insights with EPIQ Trading Floor

Mastering Fibonacci retracements requires practice and guidance. At EPIQ Trading Floor, we provide the tools and insights you need to succeed in futures trading. With a 3-day free trial, you can access advanced analysis, expert mentorship, and a community of traders to refine your skills.

For a deeper understanding of market trends, explore our crypto macro dashboard. This tool offers real-time insights into macroeconomic factors that influence trading decisions and provides traders with actionable data to stay ahead in the market.

Conclusion

Fibonacci retracements are a powerful tool for traders looking to achieve consistent wins in futures trading. By identifying key levels of support and resistance, enhancing risk management, and combining with other indicators, this strategy can give you a significant edge in the market.

Ready to elevate your trading game? Join the EPIQ Trading Floor today and start your 3-day free trial. Empower your trading journey with expert insights and cutting-edge tools.

Disclaimer: The information provided in this blog is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and you should consult with a financial advisor before making investment decisions.

Responses