As crypto evolves, one major trend is starting to take center stage:

Tokenized Real World Assets (RWAs).

If you’ve been hearing the term everywhere lately but aren’t exactly sure what it means — don’t worry.

This post will break down:

- ✅ What RWAs are

- ✅ How they’re being used in crypto today

- ✅ Why this sector could lead the next wave of adoption

- ✅ The projects to watch

- ✅ And how we track RWA trends inside the EPIQ Trading Floor

Let’s get into it.

🧠 What Are RWAs (Real World Assets) in Crypto?

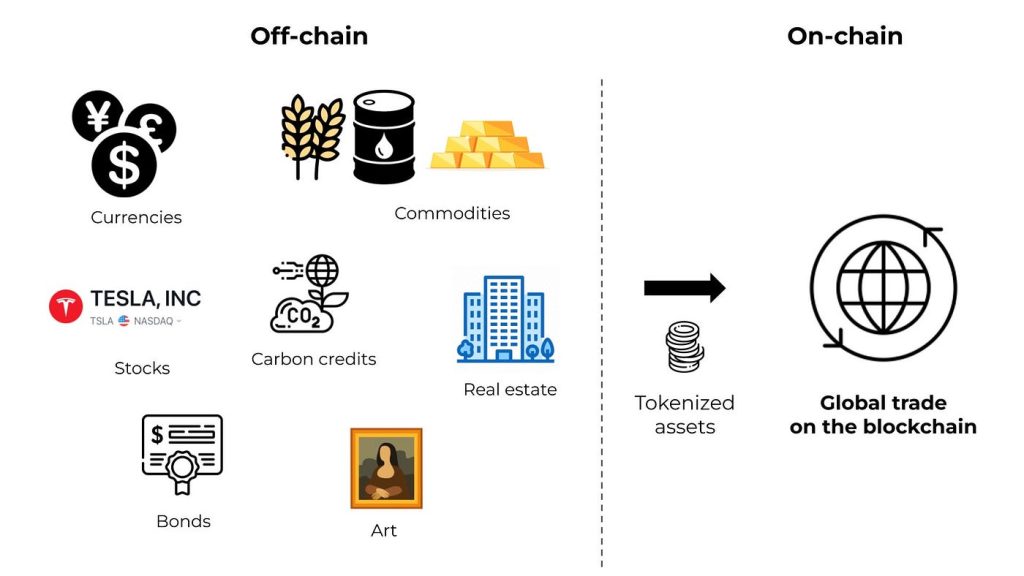

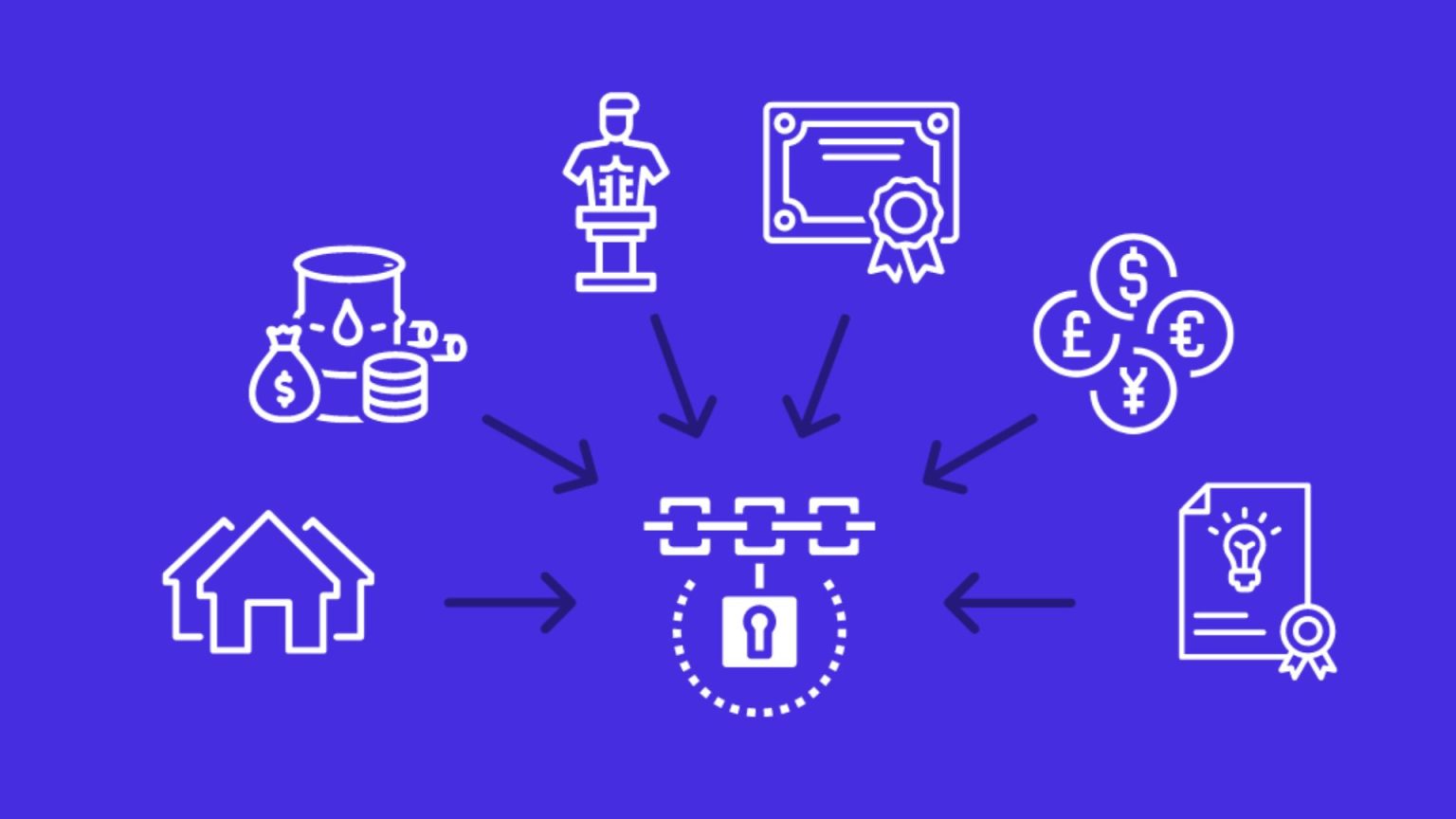

RWAs are physical or traditional financial assets — like real estate, stocks, bonds, or commodities — that are brought on-chain through tokenization.

Think of it like this:

- Instead of buying a building directly, you buy a token that represents ownership of that building (or a share of it).

- Instead of holding a U.S. Treasury bond through a brokerage, you hold a crypto version of that bond in your wallet.

By tokenizing real world assets on the blockchain, crypto is bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi).

🔗 Why RWAs Matter So Much for Crypto’s Future

Here’s why everyone’s so excited about RWAs:

✅ 1. Massive Market Opportunity

The total market value of real-world assets is over $800 trillion globally.

Even if a tiny fraction moves on-chain, it’s a game-changer for crypto market size.

✅ 2. Bringing Legitimacy to Blockchain

RWAs tie crypto to tangible assets like real estate, commodities, and real cash flow —

making blockchain technology more appealing to governments, banks, and institutions.

✅ 3. Unlocking Liquidity

Traditionally, selling real estate or art can take months.

With tokenized RWAs, ownership can be traded 24/7 on blockchain networks, massively increasing liquidity.

✅ 4. Lowering Barriers to Entry

Imagine being able to invest $100 into a luxury real estate project or a fine art piece —

without needing millions of dollars.

Tokenization fractionalizes ownership, making investing more accessible worldwide.

✅ 5. Enhancing Transparency and Efficiency

Smart contracts allow automatic tracking of ownership, dividends, and transactions —

without the need for lawyers, brokers, or tons of paperwork.

📈 Real World Asset Sectors Gaining Traction Right Now

Here’s where RWAs are already starting to take off:

- 🏠 Real Estate Tokenization (e.g., RealT, Propy)

- 🏦 Tokenized Treasuries and Bonds (e.g., Ondo Finance $ONDO, Matrixdock)

- 🖼️ Tokenized Art and Collectibles (e.g., Courtyard, MakersPlace)

- 🏢 Private Equity and Startup Shares (e.g., Securitize)

- 🛢️ Commodities like Gold, Oil, and More (e.g., Paxos Gold $PAXG)

Governments are even starting to explore using RWAs for CBDCs (Central Bank Digital Currencies) and national asset tracking.

🔥 Top Crypto Projects Focused on RWAs Right Now

- Ondo Finance ($ONDO) — Tokenizing U.S. Treasuries and corporate bonds

- Centrifuge ($CFG) — Bringing real-world credit onto DeFi platforms

- Maple Finance ($MPL) — On-chain lending against RWAs

- Goldfinch ($GFI) — Decentralized credit protocols for global lending markets

- RealT — Tokenizing U.S. real estate into fractional ownership tokens

These projects are positioning themselves at the intersection of DeFi, TradFi, and real-world economies.

🧠 How We Track RWAs Inside EPIQ Trading Floor

RWAs aren’t just hype — they’re a fundamental shift.

At EPIQ, we track RWA narratives and sector rotations daily through:

📊 Crypto Macro Dashboard

Spot early sector momentum across RWA tokens before they pop.

📚 EPIQ Trading Academy

Learn how to analyze tokenized asset projects from both a technical and fundamental perspective.

📈 Real-Time Trade Alerts

Get entry points, stop loss, and take profit levels for RWA plays — with full strategy behind each trade.

🧠 Weekly Member Calls

Review macro shifts, RWA project updates, and how smart money is positioning.

If RWAs are truly the bridge between crypto and the real world —

you’ll want to be positioned before the mainstream figures it out.

🚀 Ready to Position Yourself for the Next Big Crypto Trend?

Don’t chase hype.

Learn how to spot the narratives that actually have staying power — like RWAs.

🎯 Start your 3-day free trial now → epiqtradingfloor.com

Inside EPIQ Trading Floor, you’ll learn how to:

✅ Analyze sectors before they go mainstream

✅ Build structured trading plans around real trends

✅ Manage risk smarter — and trade more confidently

✅ Join a winning community that’s already crushing the markets

RWAs are just getting started.

Get ahead of the curve — with the right education, tools, and strategy behind you.

⚠️ Disclaimer:

This content is for educational purposes only and does not constitute financial advice. Always conduct your own research and consider your risk tolerance before investing in cryptocurrency.

Responses