Forex trading is one of the most dynamic and accessible financial markets globally, and understanding the terminology is crucial for success. One term you’ll frequently encounter is “lot.” In this blog, we’ll explore what a forex lot is, the different lot sizes, and how they impact your trading strategy. Whether you’re a beginner or looking to refine your skills, this guide will clarify the concept of forex lots and why they matter.

What is a Forex Lot?

A forex lot is the standard unit of measurement used to quantify the size of a trade in the forex market. Rather than trading individual currency units, forex trades are measured in lots to simplify transactions and standardize trade sizes across brokers.

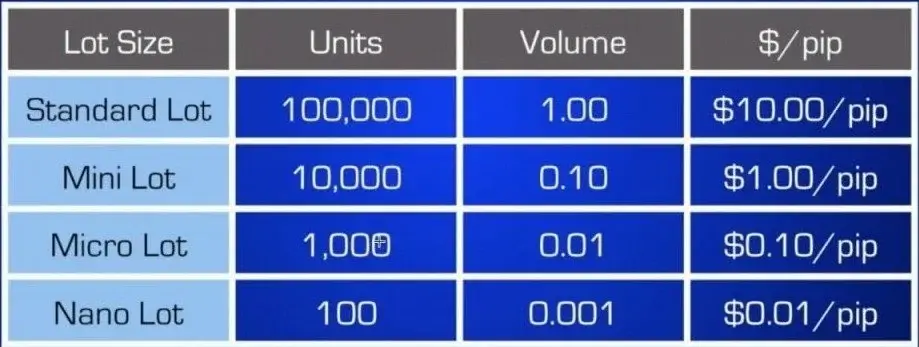

Key Lot Sizes in Forex

- Standard Lot:

- Represents 100,000 units of the base currency.

- A one-pip movement in a standard lot equals $10.

- Ideal for experienced traders with larger accounts.

- Mini Lot:

- Represents 10,000 units of the base currency.

- A one-pip movement equals $1.

- Suitable for intermediate traders.

- Micro Lot:

- Represents 1,000 units of the base currency.

- A one-pip movement equals $0.10.

- Perfect for beginners and those testing strategies.

- Nano Lot:

- Represents 100 units of the base currency.

- A one-pip movement equals $0.01.

- Available with certain brokers for traders seeking minimal risk.

Why Lot Sizes Matter

Choosing the right lot size is vital for risk management and optimizing your trading strategy. For example:

- Leverage Impact: Larger lot sizes amplify the effects of leverage, increasing both potential profits and risks.

- Account Size: Smaller lot sizes are better suited for traders with limited capital to minimize risk exposure.

- Trading Goals: Scalpers might prefer smaller lot sizes for frequent trades, while swing traders may use larger lots for higher returns.

How to Calculate Lot Sizes

Understanding how to calculate lot sizes can help you manage risk effectively. Use the following formula:

Position Size = (Account Balance x Risk Percentage) / (Stop Loss in Pips x Pip Value)

For example, if your account balance is $10,000, you’re risking 2%, your stop loss is 20 pips, and the pip value is $1, your position size would be:

Position Size = ($10,000 x 0.02) / (20 x $1) = 10,000 units (1 mini lot)

Real-World Application of Lot Sizes

According to DailyFX, understanding lot sizes and risk management is one of the foundational skills for forex traders. Traders who fail to align their lot sizes with their account balance and risk tolerance are more likely to face significant losses.

Common Mistakes to Avoid

- Overleveraging: Using large lot sizes with high leverage can quickly deplete your account.

- Ignoring Account Size: Choosing a lot size that exceeds your risk capacity.

- Lack of Practice: Failing to test lot sizes in a demo account before live trading.

Tips for Success

- Start Small: Use micro or nano lots if you’re new to forex trading.

- Monitor Leverage: Ensure your leverage ratio aligns with your risk management plan.

- Use Stop-Loss Orders: Protect your trades from unexpected market movements.

- Leverage Analytics Tools: Platforms like EPIQ Trading Floor provide tools and insights to optimize your lot size decisions.

Leverage EPIQ Trading Floor for Better Forex Trading

Navigating the forex market requires more than just understanding lot sizes. With EPIQ Trading Floor, you gain access to:

- Real-Time Market Insights: Stay updated on the latest trends.

- Advanced Tools: Analyze data and refine your strategy.

- Community Support: Learn from expert traders and connect with peers.

For specialized insights into forex trading, explore our forex dashboard. This tool offers detailed analytics and metrics to help you make informed decisions in the forex market.

Start your 3-day free trial today and take your forex trading to the next level.

Conclusion

Understanding forex lots is a critical step in becoming a successful forex trader. By selecting the appropriate lot size for your account balance and trading goals, you can manage risk effectively and increase your chances of success.

Ready to optimize your forex trading? Join the EPIQ Trading Floor today and start your 3-day free trial. Empower your trading journey with expert insights and cutting-edge tools.

Disclaimer: The information provided in this blog is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and you should consult with a financial advisor before making investment decisions.

Responses