In a world where traditional savings accounts barely pay 1%, crypto staking has exploded as one of the hottest ways to earn passive income.

But if you’re new to staking (or still unsure how it actually works), you’re not alone.

As crypto adoption grows in 2025, staking is becoming a go-to strategy for investors who want to grow their holdings without constantly trading.

In this post, we’ll break down:

- ✅ What crypto staking is

- ✅ How it works behind the scenes

- ✅ The benefits and risks you need to know

- ✅ Some of the top staking opportunities right now

- ✅ How to build a smarter staking and trading plan inside EPIQ Trading Floor

Let’s get into it.

🧠 What Is Crypto Staking?

At the simplest level, staking means locking up your crypto assets to help support the security and operations of a blockchain network — and getting rewarded for it.

When you stake, you’re:

- Helping validate transactions

- Supporting the blockchain’s decentralized infrastructure

- Earning rewards (usually paid in the same cryptocurrency)

Think of it like earning interest — but instead of a bank holding your money, you’re helping run a blockchain.

Staking typically happens on Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) networks.

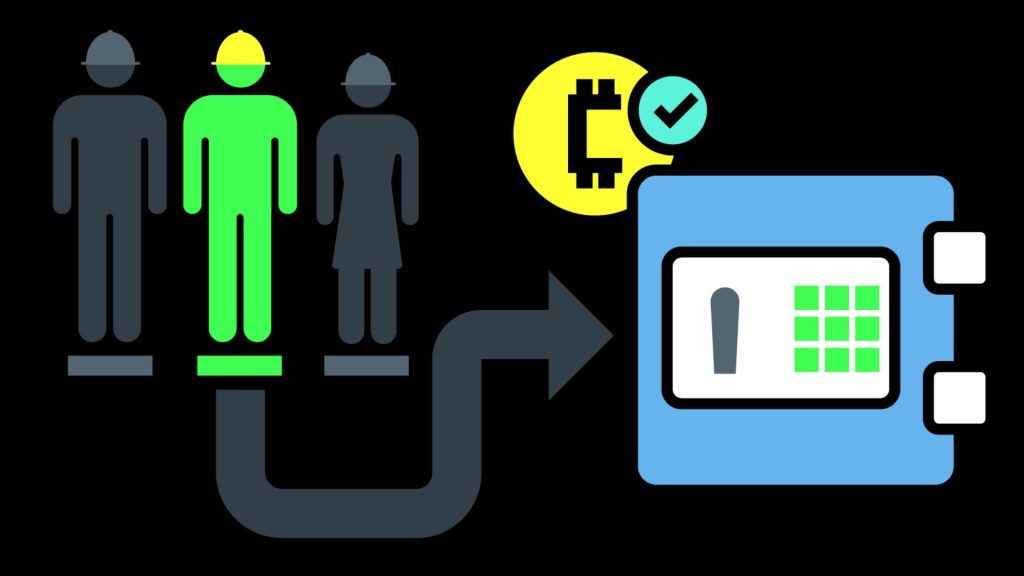

🔗 How Crypto Staking Works (Behind the Scenes)

Here’s a basic flow:

- You lock up your tokens (e.g., ETH, SOL, ADA) by delegating them to a validator or staking pool.

- Validators process transactions and secure the network.

- As a reward for securing the network, you and the validators receive newly minted coins or transaction fees.

- Your rewards accumulate over time — compounding your holdings.

Depending on the coin, network, and method you use, staking can be done:

- Directly through a blockchain wallet

- Through a centralized exchange (like Coinbase, Binance, Kraken)

- Or via DeFi platforms offering “liquid staking” (e.g., Lido)

🚀 Benefits of Crypto Staking

Why are more people staking than ever in 2025?

Here’s the upside:

✅ 1. Passive Income

You earn yield simply by holding and staking your assets — no active trading needed.

✅ 2. Compounding Growth

Some platforms allow you to auto-compound your rewards, growing your stack faster over time.

✅ 3. Supporting the Blockchain

By staking, you’re helping secure and decentralize the network you believe in — while getting rewarded.

✅ 4. Lower Volatility (Sometimes)

Staked assets are less likely to be dumped immediately since they’re locked or tied to network participation.

✅ 5. Liquid Staking Options

New innovations like Lido allow you to stake but still have a tradable version of your asset (like stETH for ETH), combining yield with liquidity.

⚠️ Risks of Crypto Staking You Should Know

It’s not all upside. Here are real risks to be aware of:

❌ 1. Lock-Up Periods

Some staking programs lock your funds for a set time — meaning you can’t sell quickly if the market tanks.

❌ 2. Slashing

If the validator you delegate to behaves maliciously or makes mistakes, you could lose part of your staked funds.

❌ 3. Inflation Risk

If reward rates are too high and demand isn’t growing, token inflation can eat into your actual returns.

❌ 4. Platform Risk

If you stake through a centralized exchange or DeFi platform, you trust them to handle your assets properly. (We all saw what happened in 2022–2023.)

📈 Top Crypto Staking Opportunities in 2025

Based on liquidity, reputation, and adoption, here are strong contenders:

🪙 1. Ethereum (ETH)

Since the Ethereum merge, ETH staking has become mainstream.

Liquid staking via Lido (stETH) is a popular option.

🪙 2. Solana (SOL)

Fast transaction times and growing DeFi activity make SOL a strong staking candidate.

🪙 3. Cardano (ADA)

One of the most decentralized PoS networks with predictable staking rewards.

🪙 4. Avalanche (AVAX)

High-yield options with growing adoption across DeFi and tokenized asset platforms.

🪙 5. Sui (SUI) / Aptos (APT)

Newer Layer 1 chains offering competitive staking yields and ecosystem incentives.

🧭 How We Combine Staking with Smart Trading at EPIQ

At EPIQ Trading Floor, we don’t just teach trading — we teach how to build wealth.

That includes:

📚 Trading Academy lessons — How to integrate staking into your portfolio plan

📊 Crypto Macro Dashboards — Track when sectors (like staking plays) are rotating hot

📈 Real-time trade alerts — Spot buy zones for great staking assets at key technical levels

🧠 Weekly live calls — Covering new staking opportunities and how to manage risk

🤝 Community support — Learn from others who are staking smart and trading smarter

🚀 Ready to Build Smarter Crypto Income Streams?

You don’t have to choose between “staking” and “trading.”

The best crypto investors do both — with structure, not emotion.

🎯 Start your 3-day free trial now → epiqtradingfloor.com

✅ Grow your stack

✅ Manage your risk

✅ Learn how to win — through every market cycle

Earn. Protect. Multiply.

That’s the EPIQ way.

⚠️ Disclaimer:

This blog is for informational purposes only and does not constitute financial advice. Always do your own research and understand the risks before staking or investing in crypto.

Responses